Greetings community,

In this blog post we will outline the mechanisms that maintain Silk's stability. Many lessons have been learned from other collateralized stablecoins, as well as collapses (such as UST) to ultimately inform how SILK economic levers were designed. The goal of SILK stability mechanisms are simple:

Ensure overcollateralization

Ensure smooth liquidations to maintain system wide collateralization

Maintain accurate oracles to protect both borrowers and liquidators

Help facilitate healthy arbitrage whenever possible

Empower the dynamic nature of SILK's target peg - one of the most powerful features besides its privacy by default

Overview

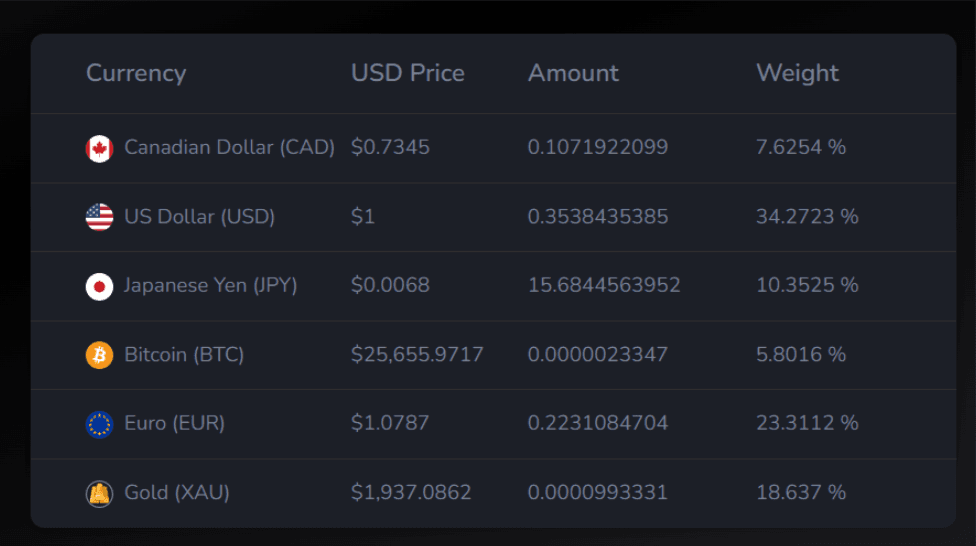

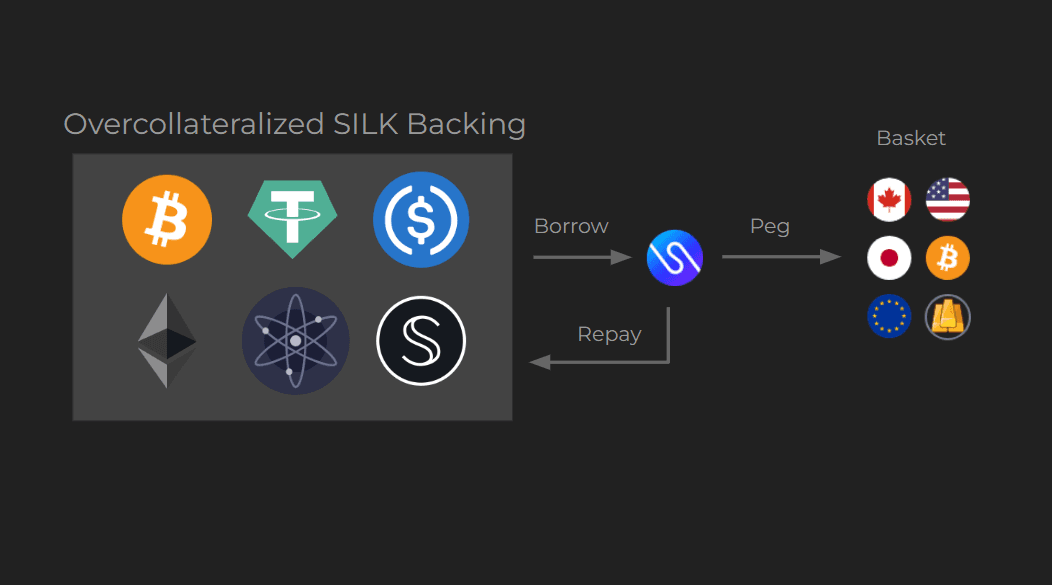

Leveraging a combination of liquidations, stability pool, and discounted debt payments, SILK is able to maintain its peg. Unique to SILK is that the peg tracks a basket of global currencies and commodities. This increases its inflation and volatility properties.

One of the most common questions of SILK is "...does SILK have a 1:1 backing with the assets its tracking?" The answer to this question is no. Instead, SILK is able to maintain the shifting target peg by using overcollateralization of other digital assets that have sufficient liquidity. SILK currently has 200% collateralization. That is to say, for every $1 worth of SILK in circulation, there is $2 worth of digital assets locked up on smart contracts backing the SILK in circulation.

Some of these assets are:

Bitcoin

Ethereum

Atom

SCRT

USDC

USDT

etc.

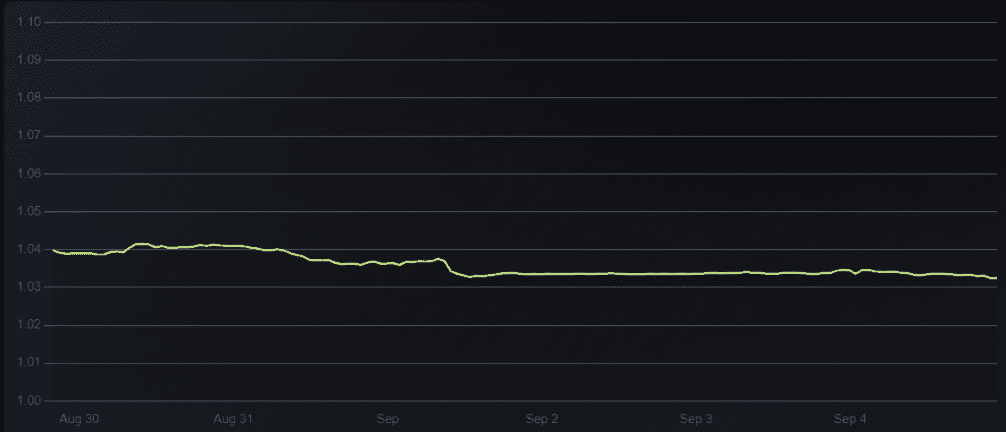

SILK peg price movement

Confused by what it means to have assets on a smart contract "backing" SILK? No worries. We will dive into that now.

The supply of SILK started at 0 back in April of 2023. How does SILK come into existence? It comes into existence via a vault - a smart contract where a user can lock up collateral to mint out SILK as a loan. As an example, imagine a user comes in an deposits $150 worth of Bitcoin. The user is allowed to borrow SILK against this collateral position. They are able to borrow up to a specified cap known as "Max LTV" (Max loan-to-value ratio). This ensures that a user cannot put system wide collateralization at risk. Whenever a user's assets and debt exceed the Max LTV, the smart contract initiates a liquidation that sells the overcollateralized assets to pull SILK out of the open market.

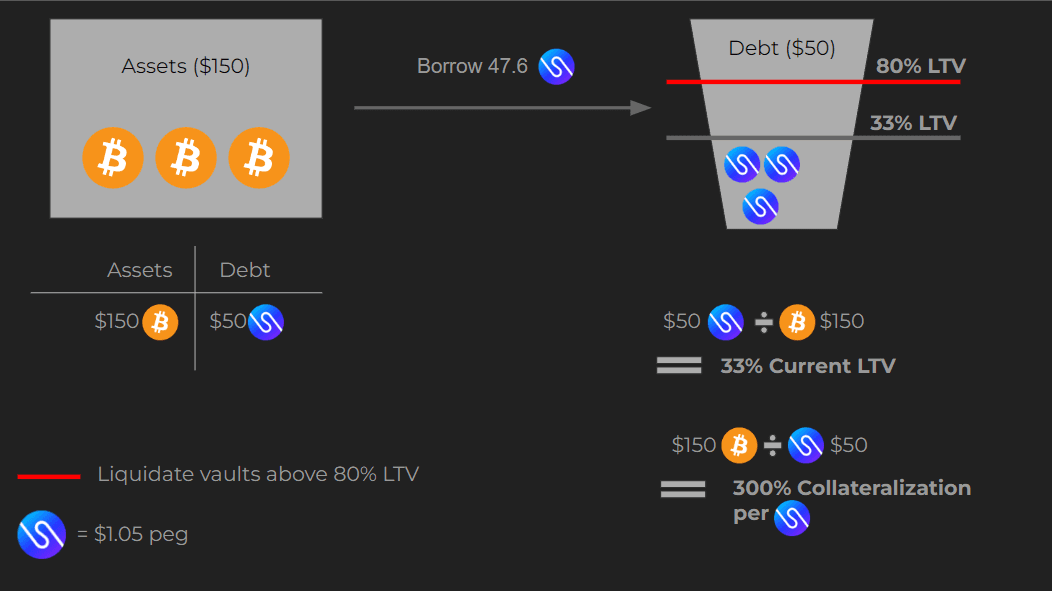

User Story

User deposits $150 worth of Bitcoin into a vault

User borrows 47.6 SILK (worth $50 at the $1.05 SILK target peg)

Their current overcollateralization is 300% ($3 of Bitcoin for every $1 of SILK that was borrowed)

Their current LTV is 33% - $1 of debt for every $3 of assets

You'll notice that the current LTV of 33% < the Max LTV of 80% - meaning that the user cannot currently be liquidated

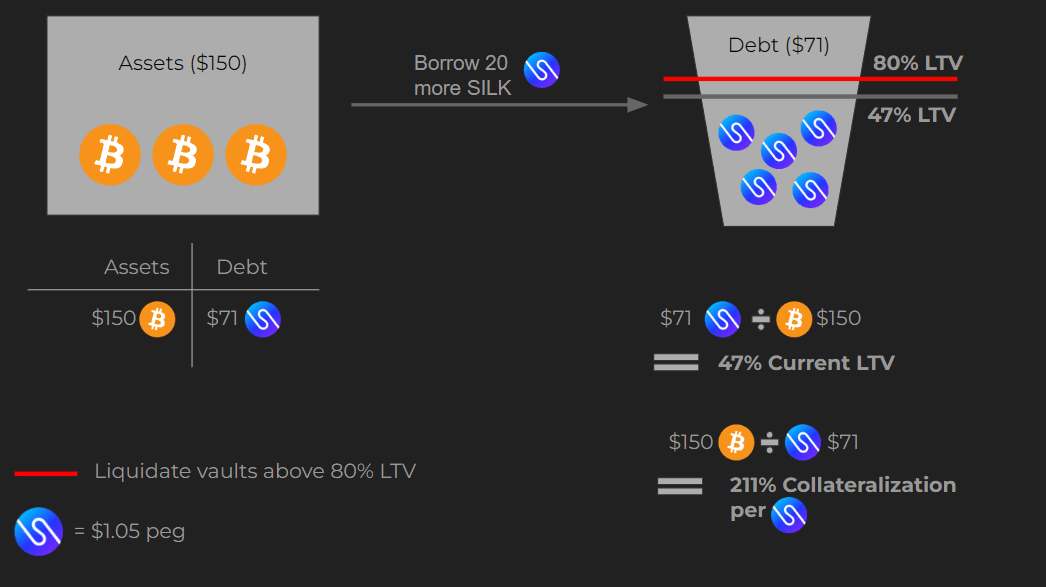

Now imagine the user decides they want to borrow even more SILK against their Bitcoin. They absolutely can! By doing so though, they put their vault closer to potential liquidation which is bad for the user as they end up losing their assets!

User borrows 20 more SILK (total debt is worth $71 at the $1.05 SILK target peg)

Their current overcollateralization is decreased to 211% ($2.11 of Bitcoin for every $1 of SILK that was borrowed)

Their current LTV is 47% - $1 of debt for every $2.11 of assets

You'll notice that the current LTV of 47% < the Max LTV of 80% - meaning that the user cannot currently be liquidated, but is getting closer.

Now, the next part of the user story is what happens when the price of the assets decrease?

Imagine the price of bitcoin has decreased by ~50%, this changes the dynamic of the vault position the user has opened because the value of the assets backing SILK are worth less than before. What's more, this pushes the user's vault position beyond the Max LTV, triggering a liquidation.

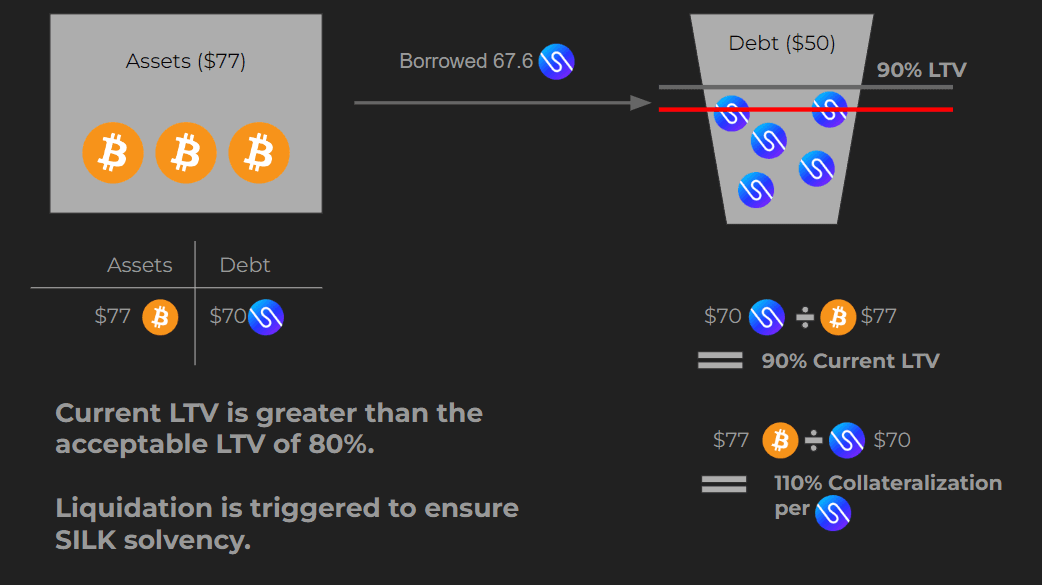

With the bitcoin price falling 50%, the assets in the vault are now worth $77 instead of $150. Notice the change in collateralization and LTV

Their current overcollateralization is decreased to 110% ($1.10 of Bitcoin for every $1 of SILK that was borrowed)

Their current LTV is 90% - $1 of debt for every $1.10 of assets

You'll notice that the current LTV of 90% > the Max LTV of 80% - this triggers a liquidation

Its important to note that the liquidation is triggered while the backing for SILK is still overcollateralized. That is to say, there are more assets than debt while the liquidation occurs.

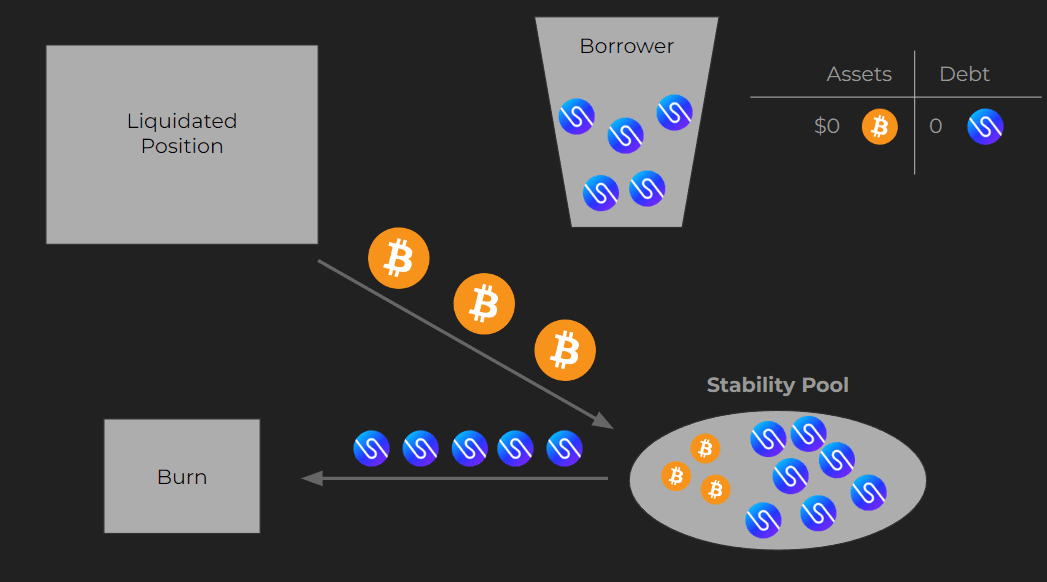

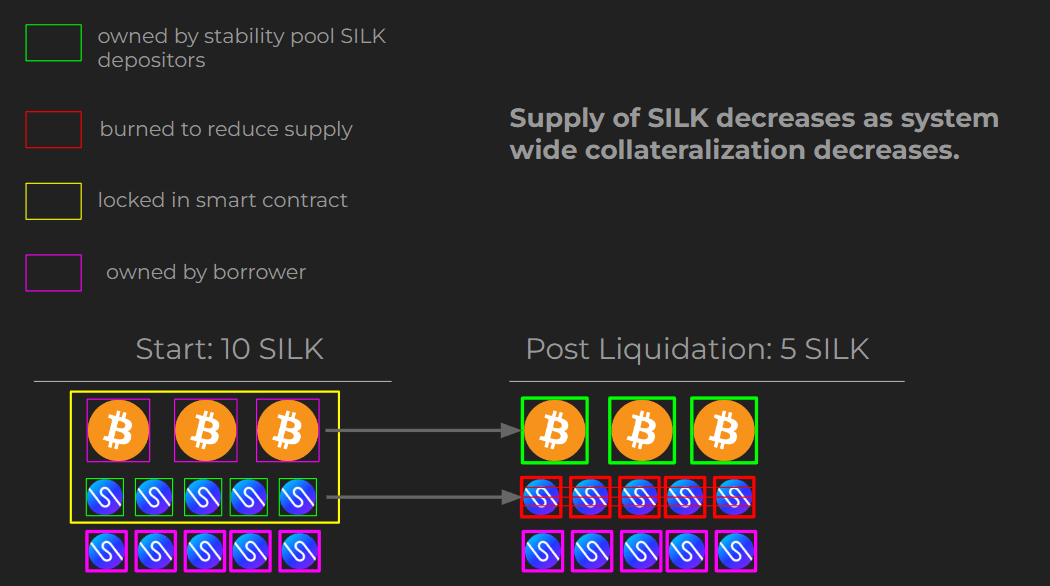

When a liquidation occurs, the assets (the $77 worth of Bitcoin) are sent to the stability pool - a smart contract where collective depositors in a pool burn their SILK in return for receiving liquidated assets.

The stability pool turns in 67.6 SILK ($70) which gets burned. In return for paying off the debt outstanding on the vault, the stability pool receives $77 worth of Bitcoin. This is the economic lever underlaying SILK's overcollateralization - that there will always be users that want to receive liquidations that exceed the value of the SILK they are turning in to the burner contract.

After this exchange is complete, assets are at $0 and debt is also at $0 - resulting in a net neutral impact on system wide collateralization.

And important thing to note is that when the borrower's assets get liquidated, they still have control over the SILK they borrowed from the smart contract. However, they lost $77 worth of assets and are left holding $70 worth of SILK. A net loss.

You now have a firm understanding of how liquidations occur - they are the mechanisms that ensures the overcollateralization property of SILK. These liquidations are made possible via the stability pool - a place where users can deposit SILK (which gets burned) and in return can earn liquidations from vaults that exceed the maximum acceptable LTV of a given vault.

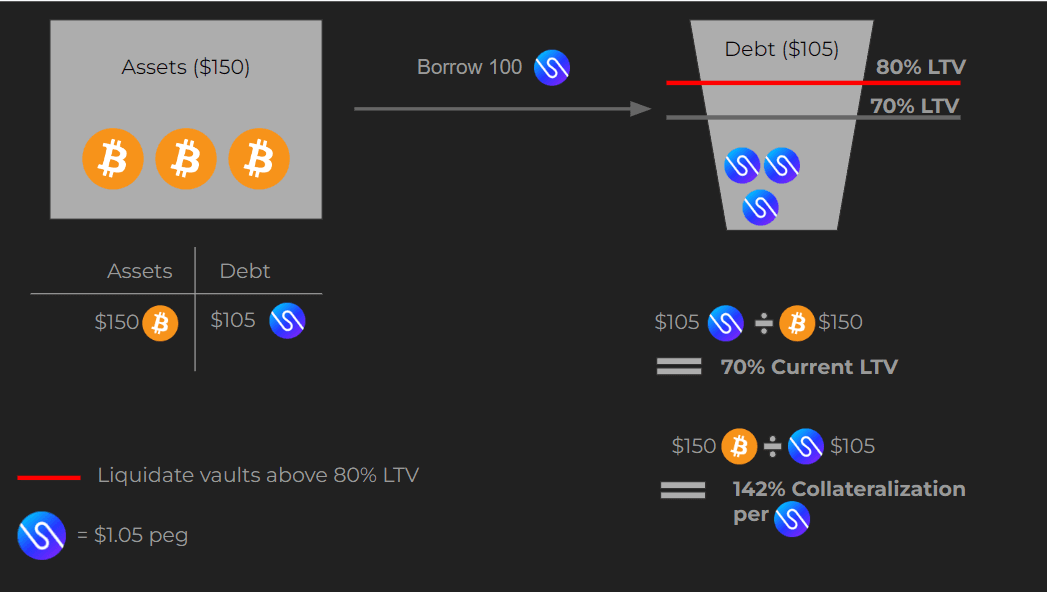

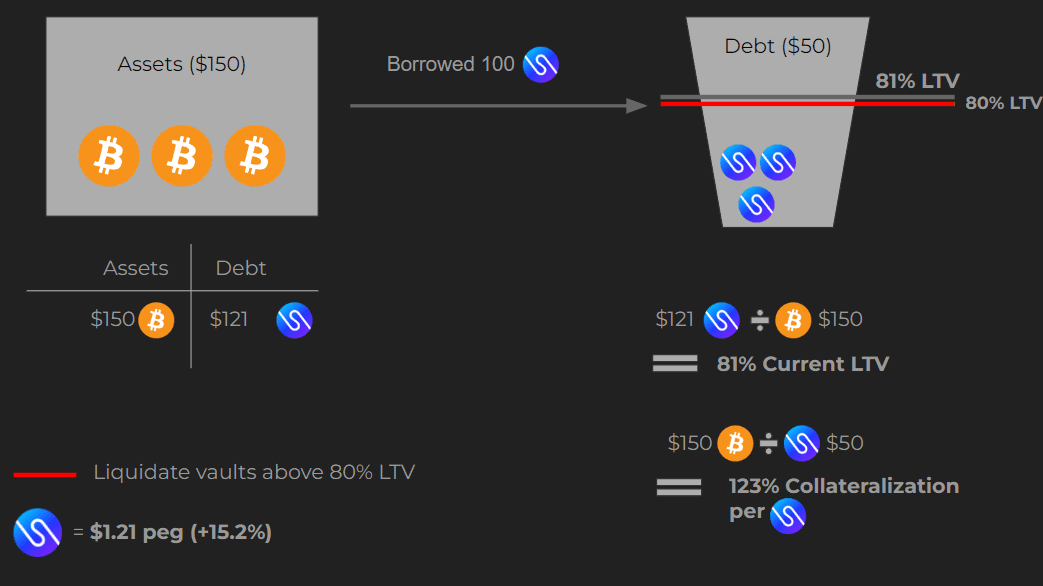

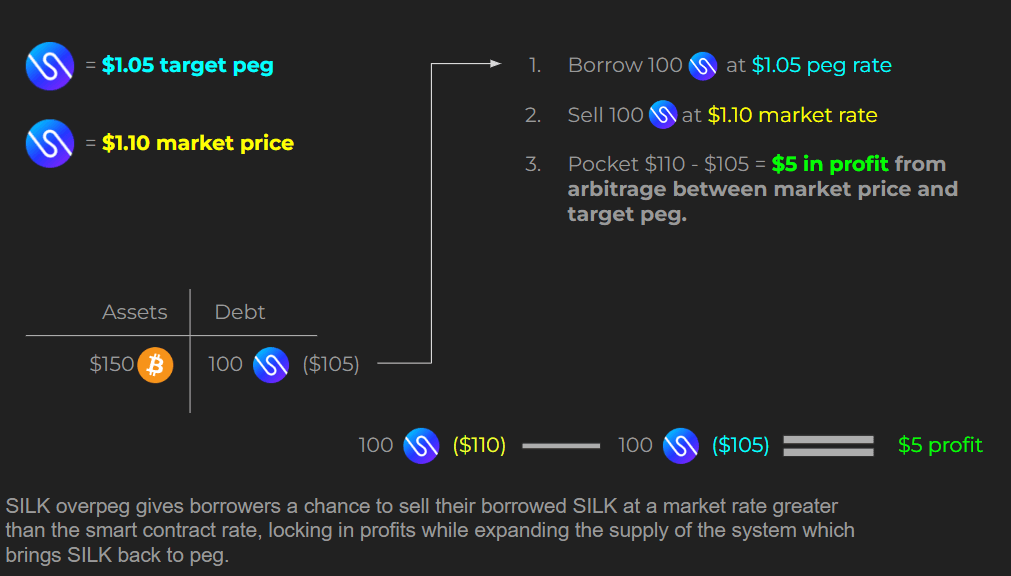

Now we will tackle a more complex feature of SILK - the fact that it is dynamically tracking a basket of currencies and commodities overtime. This means the value of SILK can increase or decrease against the US dollar. Let's assume we are back to another starting position - $150 worth of assets deposited, 100 SILK borrowed (worth $105 with the $1.05 target peg).

Their current overcollateralization is 142% ($1.42 of Bitcoin for every $1 of SILK that was borrowed)

Their current LTV is 33% - $1 of debt for every $1.42 of assets

Next, imagine that the SILK peg over the course of a year has shifted to be worth $1.21 (a 15.2% appreciation since the start of the year). This would occur if the assets in the SILK basket massively outperformed the dollar! A great outcome for SILK holders. Ultimately, the weight of this price appreciation is incurred via SILK borrowers.

Their current overcollateralization is 123% ($1.23 of Bitcoin for every $1 of SILK that was borrowed)

Their current LTV is 81% - $1 of debt for every $1.23 of assets

81% current LTV > 80% Max LTV

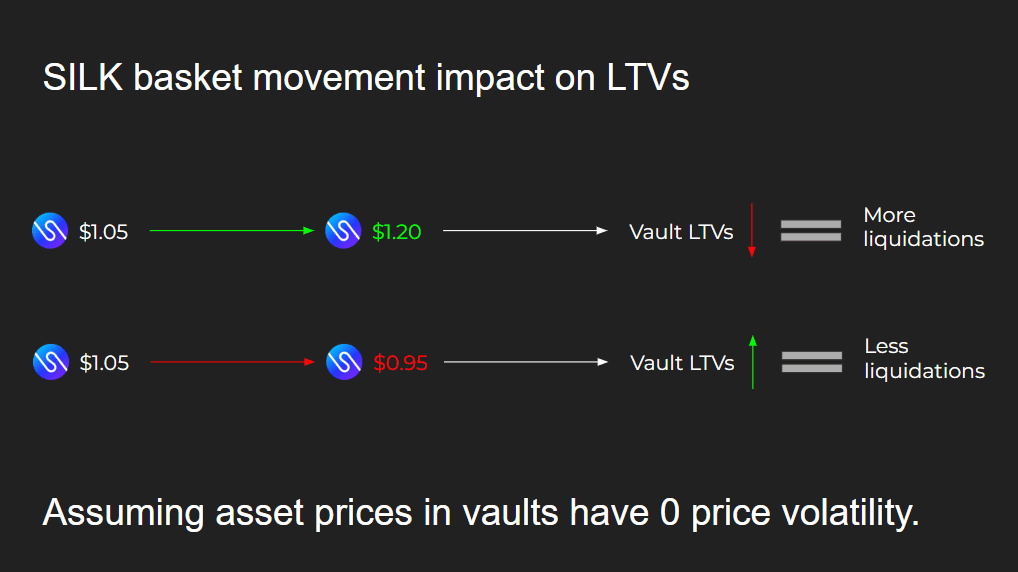

In essence, when the SILK basket appreciates against the dollar, the value of the debt the borrower is holding, increases (despite the number of SILK owed staying identical). As such, this vault over the course of a year (assuming the price of Bitcoin stayed identical) is pushed above the Max LTV threshold - triggering a liquidation.

You can summarize SILK's peg movements as whenever SILK appreciates against the dollar, there will be more liquidations due to more vaults negatively being impacted by the value of the debt increasing in value. Whenever SILK depreciates against the dollar, there will be less liquidations due to the value of the debt decreasing in value. In essence, either SILK holders or SILK vaults or winning at any given moment - a unique relationship existing between these two types of users.

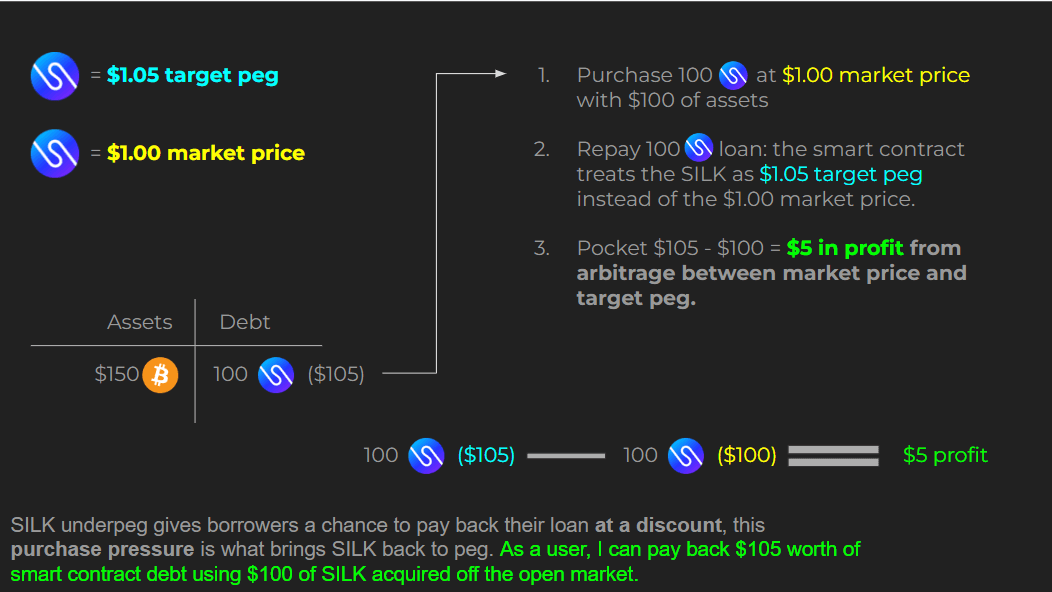

Another key question is what happens if SILK is overpeg or underpeg? Simply put, whenever SILK is underpeg borrowers have an opportunity to buy SILK off the open market to then pay-off their debt at a discount! This increase in demand for SILK in an underpeg situation is what pushes SILK back to the target peg.

Simply put, whenever SILK is overpeg borrowers have an opportunity to borrow SILK and immediately sell it on the open market - netting them a profit! This increase in supply for SILK whenever SILK is overpeg is what pushes SILK back to the target peg.

Conclusion

Without privacy, DeFi is incomplete. Traditional financial markets offer a degree of privacy for users, and as a result offer up greater protections in some capacity than existing DeFi markets. Shade Protocol will be the world’s first truly cohesive decentralized and privacy-preserving financial applications — ushering in a golden era for Web3. Shade Protocol will always push for privacy by default, privacy as an expectation, and privacy as the key to unlocking the full value of a decentralized future.

Join The Shade Protocol Community

Website | Twitter | Telegram | Medium | Discord | Learn

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.