Greetings community,

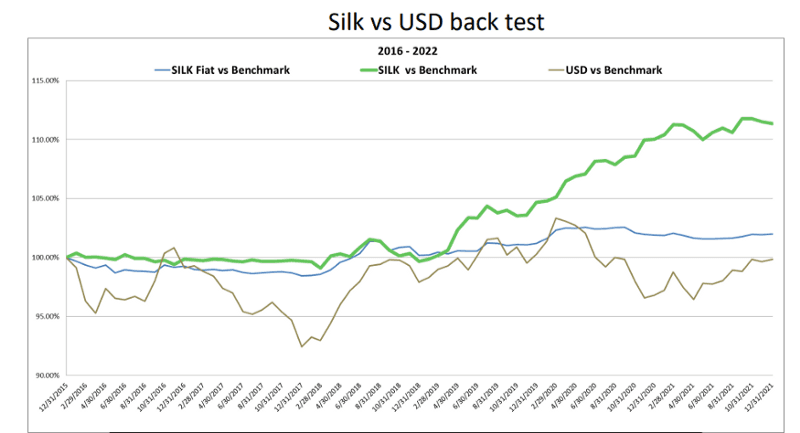

The vision for a truly global decentralized privacy-preserving stablecoin pegged to a basket of global currencies and commodities has been at the heart of Shade Protocol’s mission since the inception of Silk— uniting community members and developers around the world to make this dream a reality.

In this blog post, we will describe the rationale behind changes in Silk’s stability model in lieu of certain algorithmic stablecoins breaking, and what you can expect moving forward from Shade Protocol.

Reflections on Terra

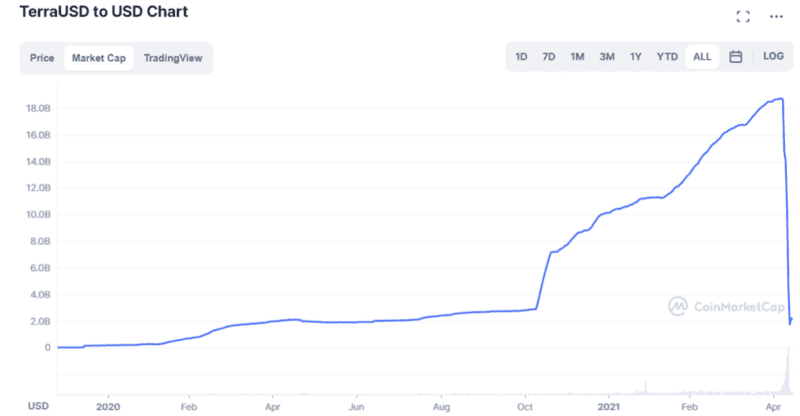

May 2022 saw the unwinding and depeg of Terra $UST, an algorithmic stablecoin (backed by Luna) pegged to the US dollar. There was over 18,000,000,000 UST in circulation prior to the economic break of UST.

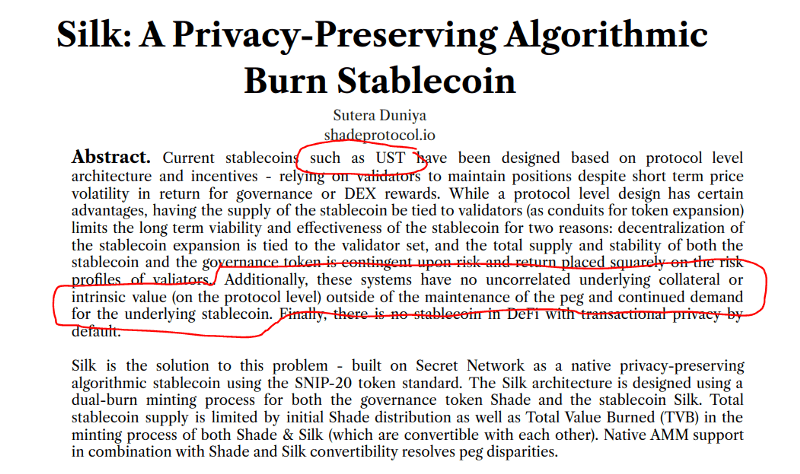

Shade Protocol had concerns about the intrinsic backing of the UST model as early as September of 2021. Despite these concerns, the design of the Silk stablecoin was on track to inherit similar assumptions that the Terra UST model held.

Original Silk whitepaper concerned about Terra’s algo model

With the recent crash of Terra UST and Luna, core contributors re-evaluated risks of the existing Silk model. In order to progress towards the safe launch of Silk, Shade Protocol is forced to challenge all of the assumptions inherited from Terra. The three key assumptions that Shade Protocol inherited from Terra were as follows:

Supply-Absorption

Asset Backing Duality

Open Liability Issuance

Basics

Before challenging these carry-over assumptions from the Terra model, we must first backtrack to core finance concepts: assets & liabilities.

Within the context of stablecoins, every single stablecoin is a liability (promise of $1 worth of redemption). In order to issue a liability, there must be assets backing the system to properly account for redemption of liabilities at large. A simple ratio encapsulates this stability:

Assets / Liabilities = Degree Of Stability

The assets within the Terra model backing the 18B $UST was the collective market capitalization of Luna (used to handle redemptions from UST to Luna), ~$1.5B worth of Bitcoin held in reserve, as well as the depth of DEX liquidity available for the sale (redemption) from 1 UST to $1 worth of assets other than Luna.

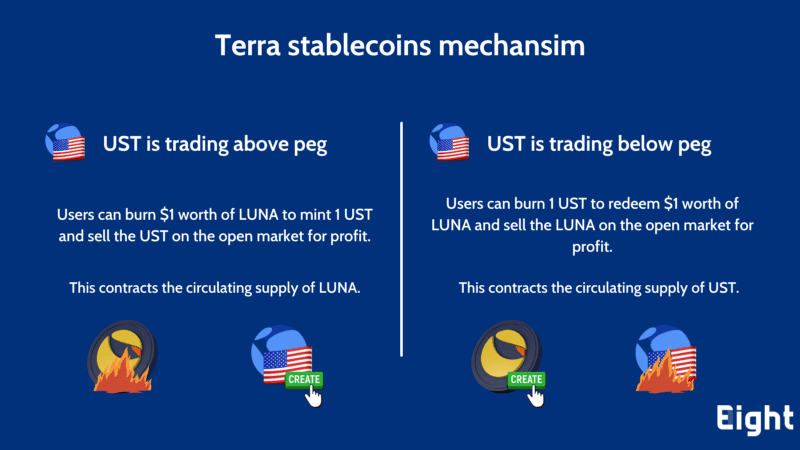

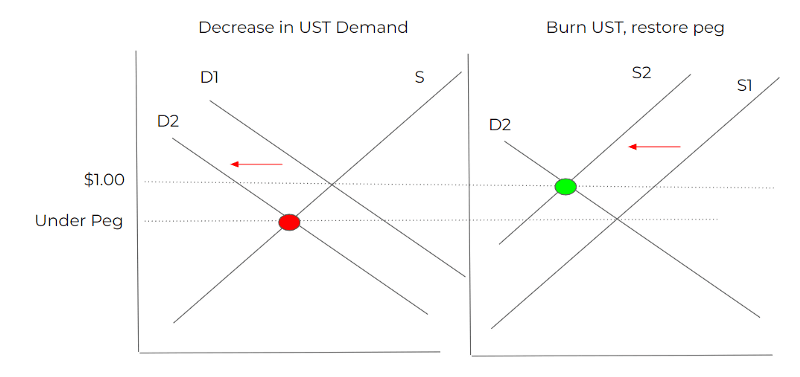

Luna maintained price disparities of UST through an extremely large arbitrage community that had deep enough pockets to profitably arbitrage price disparities between the minting contracts on Terra (UST ← →LUNA) to any DEX or CEX where there was a price disparity diverging from the target peg of $1 UST. If demand for UST slowed down (trading below peg) then the supply of Luna would expand to absorb the decrease in demand for UST.

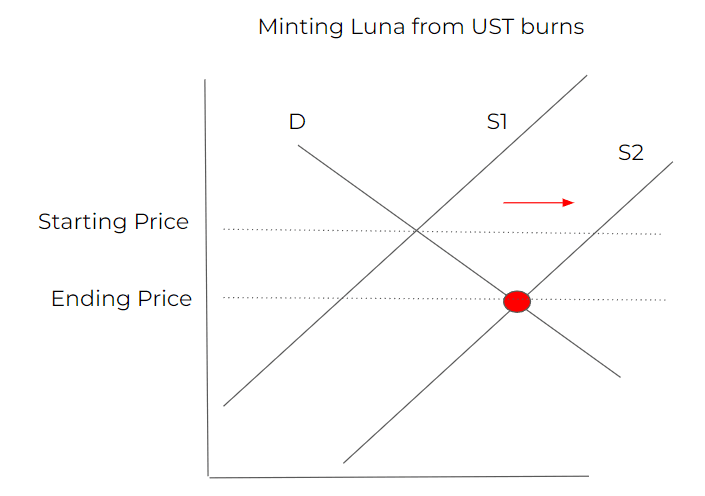

(FIGURE A) — Decrease supply of UST to restore peg

(FIGURE B) — Price of Luna decreases (via supply expansion) to absorb the burning of UST →mint Luna (redemption) that pulls UST out of circulation to bring UST back to target $1 peg

Supply-Absorption Assumption

The supply-absorption model (Figure A & B) invented by Terra worked extremely well for ~1.5 years: proving that the supply absorption model is effective during periods of time where volatility tied to demand for UST fell within acceptable ranges of standard deviation.

However, the recent unravelling of UST showed Shade Protocol that the supply absorption method used by Terra systemically struggled to handle a sudden and drastic shift in the demand for UST.

What sequence played out?

Entity accrues massive UST position

Entity sells off UST on a DEX for a different stable

Users see UST is trading under-peg due to sudden massive sell-off of UST

A subset of risk averse UST holders begin to sell their UST

A subset of risk averse Luna holders sell their Luna because they are aware that the supply of Luna is about to expand (decreasing price of Luna due to supply expansion in order to restore UST to peg)

Luna marketcap begins to drop — the key detail here is that markets were front-running the supply absorption mechanism, meaning the stability mechanism was unable to absorb the volatility because Luna holders were selling off their Luna at such a rapid pace in comparison to the supply-absorption mechanism’s ability to propagate (arb) all of the price disparities that were existing on CEXs and multiple non-Terra DEXs. The more Luna market capitalization to draw upon, the easier it is for the supply absorption method to bring UST back to parity. But because markets were aware of the supply expansion mechanism required to bring UST backed to parity, users were selling off their Luna before the market capitalization at current prices could absorb the decrease in UST demand — drastically decreasing the supply-absorption’s ability to use its self-reflexive asset backing (which takes the form of Luna’s collective market capitalization) to bring stability back to the system.

The next subset of risk averse UST holders see UST has still not restored its peg in a timely manner (because the supply-absorption is getting outpaced by sell pressure from both UST & Luna) and thus they begin to sell their UST.

Rinse/repeat steps 5-7

Prior to the breakdown of UST, Shade Protocol assumed that the supply-absorption method was agile enough to handle massive contractionary events and shifts in demand. This was the same assumption that Terra also held. Shade Protocol now holds the following evolved assumption:

The supply-absorption method works extremely well on average, but is fragile in the face of sharp decreases in demand that outpace depth of liquidity & stability arbitrage.

Asset Backing Duality Assumption

An even more fundamental assumption Shade Protocol inherited from Terra was the concept that a single volatile asset can be the primary redemption mechanism for a stablecoin without any other assets involved, or without any overcollateralization.

Without any other assets capable of stepping in to help defend the peg, a sharp decline in both UST & Luna begins a death spiral that is difficult to reverse due to the duality of the relationship between both the liabilities (UST) and the assets backing the liabilities (Luna). Shade Protocol now holds the following evolved assumption:

There needs to be multiple uncorrelated assets involved with backing algorithmic stablecoins.

Open Liability Issuance Assumption

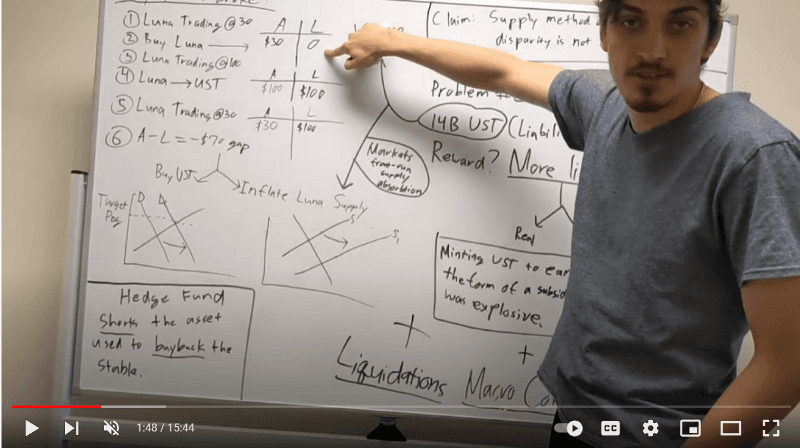

Economic Theory: Terra Depeg & Silk Model Change

While the supply-absorption & asset backing duality assumptions were both important components of Shade Protocol, the open liability issuance assumption was the most systemic problem that Shade Protocol was on the verge of inheriting from the Terra algorithmic model.

The open liability issuance assumption is as follows: it is safe for any entity at any time to issue a liability (mint a stablecoin) that the protocol will have to account for (via redemption or sale) in the future.

The attack vector that emerges from the open liability issuance assumption is as follows:

Luna is trading at $30

User purchases $30 worth of Luna (Assets = $30, Liabilities = $0)

Price of Luna increase to $100 (Assets = $100, Liabilities = $0)

User burns $100 of Luna for 100 UST (Assets = $100, Liabilities = $100)

Price of Luna decreases to $30 (Assets = $30, Liabilities = $100)

Because users are able to issue liabilities (mint UST) at any time in Terra, the protocol is given bad debt whenever the asset (Luna) backing the liabilities decreases from a point in time since the issuance of a liability. Shade Protocol now holds the following evolved assumption:

It is dangerous for any entity, other than the protocol, to have the ability to issue a liability in the form of a stablecoin that the protocol will have to account for via redemption or sale in the future.

Silk Evolved

OLD Silk model from early 2021. Green section = overcollateralized. Orange = algorithmic.

Listed above is an ancient model of Silk from early 2021. Shade Protocol originally had plans to support overcollateralized minting of Silk after the initial launch of the algorithmic components (Silk ← →SHD). However, a lot has changed with stablecoins since early 2021. Due to the Terra UST crash, consumer support and trust of algorithmic stablecoins are (rightfully) at an all time low.

After a distinct period of deliberation & analysis, the following conclusion was arrived at for next steps:

Shade Protocol core developers and economists are planning to launch Silk as an overcollateralized stablecoin built with modularity that could allow for integration of future stability, issuance, and redemption mechanisms.

Currently, new Silk simulation and modeling software are actively being developed in order for Shade Protocol contributors to have a better understanding of how Silk can continue to evolve its stability, issuance, and redemption mechanisms in light of how Shade Protocol is moving away from the flawed Terra model assumptions. Despite the conviction to continue to iterate on stablecoin models, Shade Protocol core contributors are aiming to launch Silk with a stability model that is proven to be safe (DAI, MIM) while also giving Silk the flexibility to modularly evolve overtime after exhaustive research and simulations.

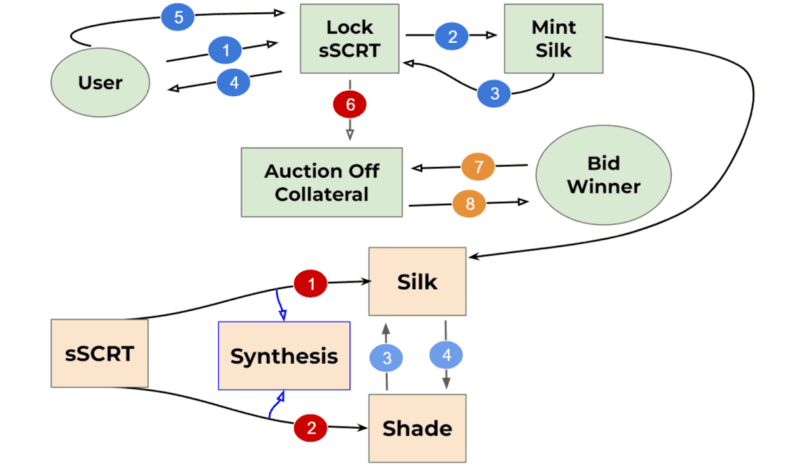

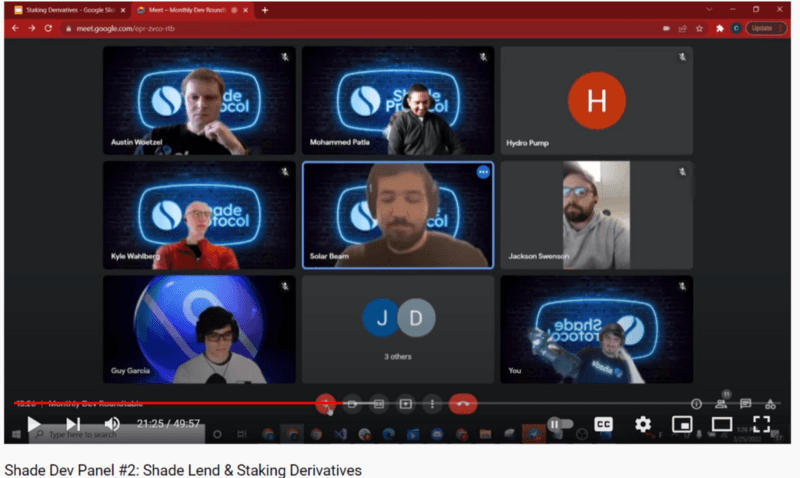

Fortunately for Shade Protocol, the Shade Lend team has been developing the overcollateralized version of the Silk model since January 2022. Over five months of work has already put into development for the overcollateralized model of Silk. As such, the builders are optimistic about the timeline of Silk’s launch.

Silk Lend Team Update on Overcollateralized Model

Silk Changes

What has not changed about Silk is the following:

Privacy-preserving

Auditable

Perpetual hedge against global volatility

Pegged to a basket of global currencies & commodities (~$1.05)

Decentralized

Fast

Smart contract compatible

Cross-chain

What is planned to change for Silk is the following:

Overcollateralized

Modular

Value Accrual Impact

With an adjustment in stablecoin model inevitably comes a switch in value accrual for SHD tokenholders. While a change to the overcollateralized model gives up a degree of profitability in return for stability, there are still fundamental revenue streams in the form of interest accrued and liquidations tied to this new model. The following is an updated list of revenue streams that are in development for Shade Protocol:

Silk transaction fees

Interest fees

Liquidation fees

10 years of SHD staking rewards

Shade Treasury L1 staking rewards

Shade Treasury LP participation rewards

stkd-SCRT liquid staking derivative fee stream (Launched)

stkd-SHD liquid staking derivative fee stream

Protocol arbitrage

More to be announced June 7th

Next Steps

To reflect what has changed about Silk, here is a list of action items you can look forward to from Shade Protocol:

Updated Silk Whitepaper

Updated Shade Protocol Whitepaper

Economic Simulations & Models

Silk Launch Timeline

Developer Updates

Audit Updates

Conclusion

Shade Protocol is an ambitious array of application-layer products focused on a simple end user experience that involves the incorporation of privacy by default. These interconnected privacy-preserving DeFi products built on Secret Network will change DeFi as we know it — empowering the next generation of value creation and exchange. Shade Protocol is launching Silk: a privacy-preserving collateralized, reflexive stablecoin built on Secret Network.

Without privacy, DeFi is incomplete. Traditional financial markets offer a degree of privacy for users, and as a result offer up greater protections in some capacity than existing DeFi markets. Shade Protocol will be the world’s first truly cohesive decentralized and privacy-preserving financial applications — ushering in a golden era for Web3. Shade Protocol will always push for privacy by default, privacy as an expectation, and privacy as the key to unlocking the full value of a decentralized future.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.