Shade Protocol is bringing privacy-preserving SNIP-23 liquid staking derivatives to Secret Network, enabling users to secure Secret Network and other application protocols without exposing their privacy!

Landing Page: https://shadederivatives.io/

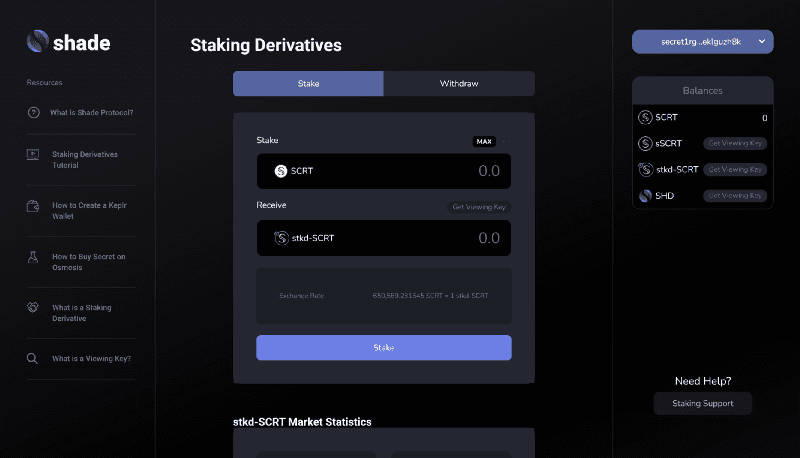

Staking Derivative App: https://app.shadeprotocol.io/staking-derivatives

Contract: secret1k6u0cy4feepm6pehnz804zmwakuwdapm69tuc4

Simply purchase or mint a liquid staking derivative (such as stkd-SCRT) and immediately start to privately accumulate staking rewards while simultaneously putting your staking derivatives to work with liquidity providing, lending, trading, and more.

Shade staking derivatives (denominated as “stkd” pronounced “staked”) empower the following:

Fungibility

Private staking

Automatic reward compounding

Compounded staking rewards without triggering a taxable event

LP opportunities

Flexibility

Reduction of validator risk by automatically spreading delegations out to multiple performant validators

Shade Launches stkd-SCRT

The initial Shade staking derivative product (stkd-SCRT) is Secret Network’s first staking derivative live on mainnet.

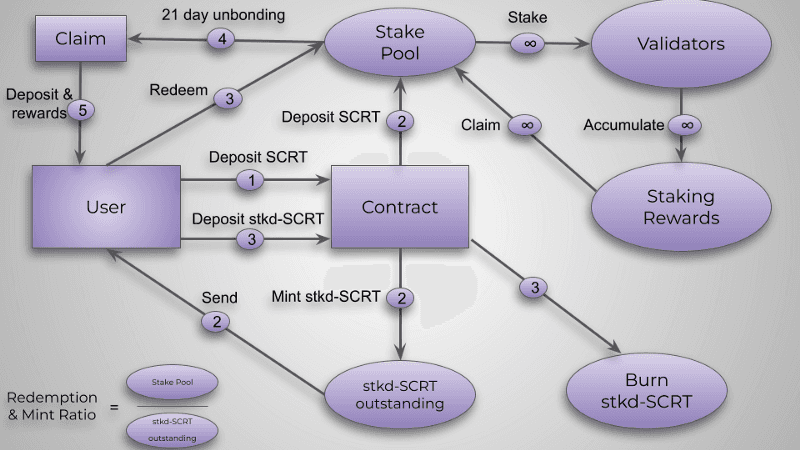

stkd-SCRT is a Shade staking derivative that represents staked SCRT on Secret Network, combining the cumulative value of deposited SCRT collateral with compounded staking rewards via the staking derivative contract. stkd-SCRT tokens are minted via deposits of SCRT.

When stkd-SCRT are redeemed, they are burned in return for the originally deposited SCRT and respective accumulated staking rewards after a 21 day unbonding period. With stkd-SCRT, a percentage of staking revenue goes directly back to Shade stakers and the ShadeDAO — creating an additional sustainable revenue stream for SHD holders!

If you are both a SHD holder and a SCRT staker, you are highly incentivized to use stkd-SCRT versus other staking derivatives!

How Does Shade Staking Derivatives Work?

To mint stkd tokens, users must deposit stakable collateral (such as SCRT or SHD) into the staking derivative contract. Next, the contract mints out a corresponding liquid stkd token for the user.

SCRT ←→ stkd-SCRT (live)

SHD←→ stkd-SHD (in development)

The minted stkd token represents a redeemable claim on the deposited collateral and rewards accrued by the respective staked collateral.

User Story

Initial Stake Pool = 100 SCRT

stkd-SCRT Outstanding = 100

Minting Ratio = SCRT in Staked Pool / # of minted stkd-SCRT

Initial Minting Ratio = 100 / 100 = 1:1 SCRT per stkd-SCRT

Mint stkd-SCRT

A user deposits 100 SCRT into the stkd-SCRT contract

Contract mints 100 stkd-SCRT for the user

The deposited SCRT is staked by the contract — the SCRT stake is split between a list of performant validators

Stake Pool =100 Initial Stake Pool +100 Deposited SCRT = 200

Rewards Accrue In Stake Pool

10 days elapse

5 SCRT worth of staking rewards are generated by the staked SCRT

Stake Pool = 200 + 5 (accrued rewards)=205 SCRT

Minting Ratio →(205 SCRT / 200 stkd-SCRT outstanding)

Minting Ratio = 1 stkd-SCRT per 1.025 SCRT

Mint More stkd-SCRT

User deposits 105 SCRT at the 1.025 Minting Ratio

Contract mints out 102.43 stkd-SCRT (105 SCRT /1.025 Minting Ratio)

Stake Pool = 205 + 105 = 310 SCRT

stkd-SCRT Outstanding = 200 outstanding + 102.43 minted

Minting Ratio = 310 SCRT in Staked Pool / 302.43 stkd-SCRT outstanding

Minting Ratio = 1 stkd-SCRT per 1.025 SCRT

Appreciation Rate

With each additional minting of stkd-SCRT, more SCRT is deposited and staked. This generates more rewards that accrue towards the staked pool. Because each new stkd-SCRT minter deposits at the same linear rate, the price increases the same for everyone proportionally.

The price of stkd-SCRT continues to go up at the same rate of Secret Network proof-of-stake compounded rewards. All while users can buy, sell, transfer, and unbond with their stkd tokens.

Sell

User wants to sell their 100 stkd-SCRT for their proportion of SCRT and accumulated rewards to date. Instead of waiting redeeming their stkd-SCRT and waiting for the 21 day unbonding period, the user instead decides to sell their stkd-SCRT for SCRT on a DEX.

Redeem

Assume the current minting rate is 1.30 — time has elapsed and more rewards have accrued. A user deposits 100 stkd-SCRT back into the staking derivative contract for redemption of their initially deposited collateral + rewards. After 21 days of unbonding, the user is able to claim their 130 SCRT from the staked pool.

Grow Shade Protocol

Shade staking derivatives apply a 0.20% fee on minting, and a 0.05% fee on redemption.

The ShadeDAO will use the fee revenue stream to help generate more liquidity on DEXs for stkd-SCRT pairs, creating sustainable protocol owned stability and a better user experience. With the intentional design of the feedback mechanism, by purchasing or creating Shade liquid staking derivatives you are helping grow an entire ecosystem of privacy-preserving DeFi products on Secret Network!

Buy Privacy Staking Derivatives

Shade Staking derivatives are partnering with Sienna (a DEX / AMM) to create a place for users to liquidity provide their staking derivative tokens while also passively earning staking rewards. Additionally, users will be able to obtain stkd-SCRT on this exchange. Shade staking derivatives are slated to come to other DEXs in the future, so stay tuned.

Governance

Governance logic exists within the staking derivative contract that will allow both SHD and stkd-SCRT tokenholders to be able to vote on Secret Network governance proposals. This is a unique feature that empowers Shade Protocol as an application layer protocol to partake in governance. This particular duel governance feature set is on the roadmap, and has a distinct amount of research and development remaining. Initially, vote will be distributed throughout the validator set for voting.

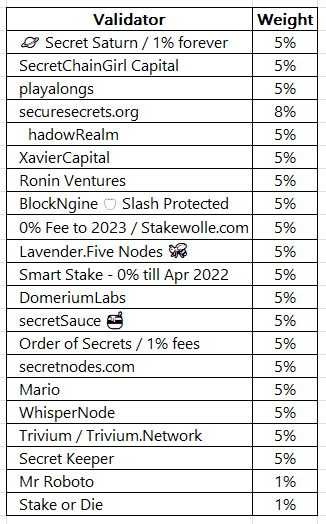

Validator Set

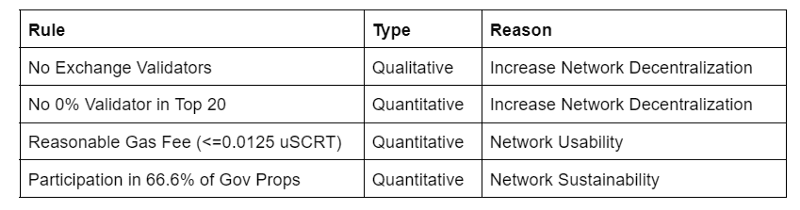

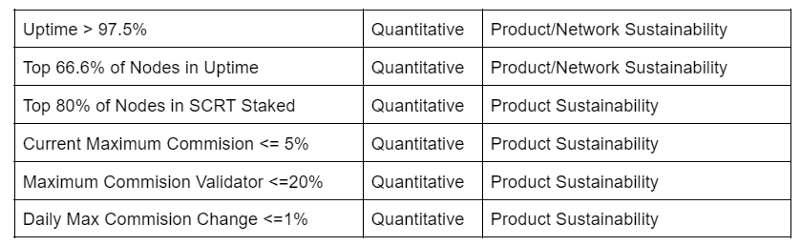

One of the primary differentiators of stkd-SCRT is how the validator set is chosen. The following are the set of 21 validators selected for quarter one, which will be revisited quarterly.

By outlining the requirements to join the validator set. stkd-SCT can create transparency and foster inclusion into the staking derivative set. Exclusion from the list is not permanent and validators should be able to understand how they can be included in the next update. The barrier to entry may require validators to compromise on fees, to participate in governance, or to make their infrastructure more robust.

Secure Secrets has the highest weighting in the validator set due to (1) running the bot that spends SCRT to auto-compound staking rewards for all stkd-SCRT holders (2) primary developer group growing the product. Mr. Roboto & Stake or Die are also included as core developers and are included in the set as well.

stkd-SCRT Unbonding

Secret Network has a default limit attached to the # of times that a user can simultaneously unbond staked SCRT. That limit is 7 unbondings. If you are staking on Secret Network and try to unbond 8 times in succession, you will get an error informing you that you have reached a maximum limit of unbondings allowed — forcing you to await for the other unbondings to complete before you can attempt to unbond again.

With staking derivatives, a single contract address is staking all the SCRT for stkd-SCRT users — with no creative changes to the contract, this would mean that only 7 unbondings would be allowed across all redemption claims made by stkd-SCRT user. If the contract tried to unbond 8 times, everyone who owns stkd-SCRT would not be able to unbond until 1 of the 7 unbondings is complete.

In other words, if anyone wanted to lock stkd-SCRT forever as an attack vector, they would just need to call the unbond function on the contract seven times in succession and then keep unbonding small amounts when any of those are complete — breaking user’s ability to claim their SCRT into perpetuity.

Enter batch unbondings as a creative solution.

With batch unbondings, users that are unbonding have their SCRT placed into batches that unbond every 3 days (21 days unbonding / 7 unbonding slots), empowering users to safely claim their collateral and rewards while removing a distinct attack vector enabled by default Secret Network settings.

stkd-SCRT Spread Rebalance

Every 21 days, the contracts trigger a “spread rebalance” where SCRT will be redelegated back to the target weights listed in Table A, ensuring that as SCRT is added to the staking pool that it is evenly distributed to the target weights. This unique feature ensures proper decentralization of delegation if any imbalances are incurred during the randomized-weighted delegation strategy.

What are the risks of staking with stkd?

There exist a number of potential risks when staking SCRT using liquid staking protocols.

Smart contract security

There is an inherent risk that stkd could contain a smart contract vulnerability or bug. The stkd code has been audited to minimize this risk.

DAO key management risk

Slashing risk

stkd-SCRT & stkd-SHD price risk

Security of stkd

stkd is a secure liquid staking solution for a number of reasons:

Successfully audited

Selection of best-in-class highest performant validators to minimize staking risk.

Use of non-custodial staking service to eliminate counterparty risk.

Use of DAO for governance decisions & to manage risk factors.

The Builders

Shade Staking and the various liquid staking derivatives is a collaboration between Stake or Die, Baedrik, and Secure Secrets. Thank you to all the hard work done by the developers to help make this product a reality for end users.

Shade Staking Roadmap

Q1 2022: stkd-SCRT

Q2 2022: stkd-SHD

Q3 2022: integrate with lending products

Q4 2022: governance + cross-chain staking derivative products

Shade Protocol Community

Stay tuned for more updates!

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.