The next wave of innovation has arrived.

Lending and borrowing are some of the highest demanded DeFi building blocks in crypto. The ability to borrow something like Bitcoin while using Ethereum as collateral has empowered billions of dollars worth of financial expression. DeFi money markets have seen over $50B+ in total value locked — featuring massive liquidation markets, lenders, and borrowers.

However, money markets lack encryption.

Billions of dollars of lending and borrowing are exposed for the whole world to see, risking targeted liquidation cascades.

Enter ShadeX — the world’s first encrypted money market.

Lend, borrow, and liquidate safely and privately without the prying eyes of a block explorer.

ShadeX launches March 5th, 2025.

In this article we will explore →

Money Market Flaws — No Data Security

ShadeX Opportunity — An Encrypted Money Market

ShadeX = Omnichain eXpansion

How Money Markets Work

Liquidity Bootstrapping — Borrow & Supply Rewards

Encrypted Cross Margin Positions

Encrypted Flash Loans

Collateral Swaps

xTokens — Liquid Lending

LP Tokens As Collateral

xTokens As Collateral

Private Protocol Liquidations & Public Liquidations

The SHD MetaEngine x ShadeX — An Interwoven Economy

Conclusion

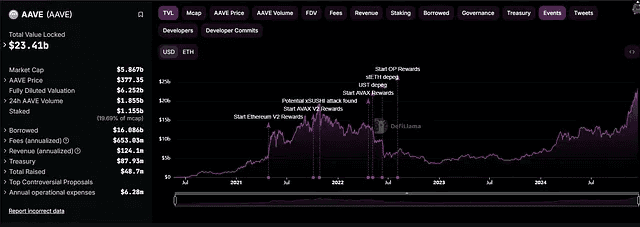

Aave ($5.8B marketcap) has seen a wave of adoption in 2024; over $20B in capital calls Aave home, with tens of thousands of daily active users leveraging the platform on Ethereum. All of this capital with MASSIVE data exposure risk.

Money Market MASSIVE Flaws— No Data Security

Within this billion dollar DeFi vertical is room for massive disruption. The current state of money markets makes it so that any user can view any leverage position of another user.

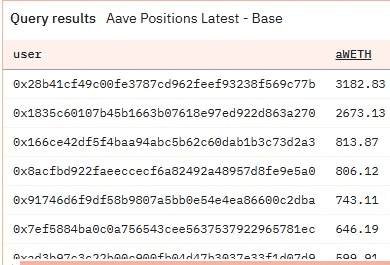

https://dune.com/queries/4104775

Below is a screenshot of a Dune Analytics query revealing the following:

All deposits

All borrowings

All liquidation price points

All interest accrued

As billions of additional liquidity onboards into the lending and borrowing of Web3, data security creates a PvP environment where large capital actors are encouraged to coordinate to liquidate other users in a programmatically guaranteed way. This is a massive deterrent to adoption for additional Web3 users and institutions.

Data security is a mission critical promise that is required for money markets to scale to the next tier of liquidity.

Traditional finance products and markets protect individuals better than Web3.

ShadeX Opportunity — An Encrypted Money Market

ShadeX isn’t just an iterative improvement. ShadeX is an exponential leap forward for encrypted DeFi. This innovative platform introduces a suite of industry-defining features, ensuring unparalleled security and privacy in every transaction.

Encrypted liquidation price points protect sensitive data, preventing market manipulation. Encrypted lending and borrowing provide a secure environment for financial interactions, fostering trust and confidence among users. Encrypted deposits and liquidations ensure that funds and assets are handled with the utmost confidentiality, maintaining the integrity of user investments. Finally, encrypted collateral swaps offer seamless and secure asset management, making ShadeX the ultimate solution for anyone seeking a robust, private, and cutting-edge DeFi experience.

ShadeX is revolutionizing DeFi with the first encrypted money market, setting a new standard for privacy, security, and financial freedom in Web3. By addressing critical flaws in traditional money markets, such as the lack of data security, ShadeX empowers users to lend, borrow, and liquidate assets with confidence, free from the risks of targeted attacks and market manipulation. With the global DeFi market projected to surpass $150 billion in TVL in 2025, ShadeX is poised to capture a significant share by offering unparalleled encryption features that traditional platforms like Aave and Compound cannot match.

As the platform scales, we anticipate onboarding billions in liquidity and thousands of daily active users who value privacy as a cornerstone of their financial strategy. ShadeX isn’t just redefining money markets — it’s shaping the future of private, unstoppable decentralized finance.

ShadeX = Omnichain eXpansion

ShadeX is in development to become an omnichain platform (with its first deployment on Secret Network). This omnichain strategy is a pivotal moment in the evolution of encrypted decentralized finance. By integrating with networks that support Trusted Execution Environments (TEEs), Zero Knowledge Proofs (ZKPs), Fully Homomorphic Encryption (FHE), and other advanced cryptographic technologies, ShadeX is setting a new standard for diversified privacy, security, and interoperability for DeFi products.

Why is this so important?

Unparalleled Privacy and Security:

By leveraging networks that support ZKPs and FHE, ShadeX ensures that all transactions and data interactions are encrypted and secure. Users can engage in lending, borrowing, and liquidating without fear of data exposure or targeted attacks.

2. Advanced Cryptographic Integration:

Integrating advanced cryptographic technologies like ZKPs and FHE enhances the overall security framework of ShadeX. These technologies allow for confidential and verifiable transactions, ensuring user privacy while maintaining the integrity of the system.

3. Interoperability with Cutting-Edge Networks:

ShadeX’s omnichain approach connects it to multiple blockchain networks that prioritize privacy and security. This interoperability allows users to take advantage of the unique features and benefits offered by each network, fostering a more versatile and dynamic DeFi ecosystem.

4. Resilience and Flexibility:

Operating on multiple blockchains that support advanced cryptographic techniques provides greater resilience against network-specific vulnerabilities and ensures continuous uptime. Users can choose the most secure and efficient network for their transactions, enhancing their overall experience.

5. Broader User Base and Adoption:

By expanding to networks that prioritize privacy and security, ShadeX can attract users who value these principles, including institutional investors and privacy-conscious individuals. This inclusivity promotes wider adoption and strengthens the network effects of the platform.

6. Enhanced Liquidity:

Tapping into the liquidity pools of multiple secure networks ensures that users have access to deeper markets and more diverse financial opportunities. This results in lower slippage, better rates, and a more efficient capital flow.

ShadeX’s omnichain expansion is not just a technological upgrade; it is a strategic move to redefine the boundaries of decentralized finance and encrypted borrowing and lending. This bold step ensures that ShadeX remains at the forefront of DeFi innovation, catering to the growing demand for versatile and comprehensive financial solutions.

ShadeX will be announcing its first EVM omnichain encrypted DeFi expansion partner in March of 2025.

How Money Markets Work

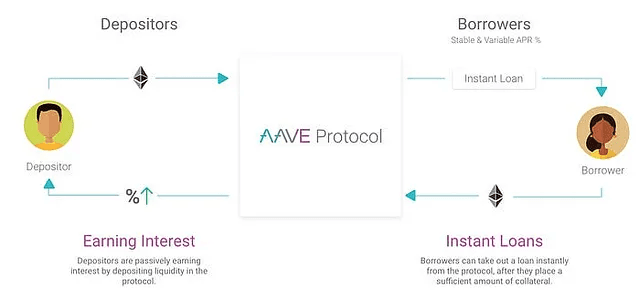

The mechanics of money markets are simple, there are four different key counter parties involved:

Protocol: The numerous smart contracts and configuration files that define the dynamics between lenders and borrowers, including interest rates, whitelisted collaterals, liquidations, and more.

Lenders: Users who deposit ETH, BTC, ATOM, and other assets to be borrowed by others. Lenders passively earn interest from borrowers. When lending pool utilization rates are high, it can be challenging for lenders to withdraw their initial deposit. To compensate for this reduced liquidity availability, lenders earn higher interest rates as utilization rates increase, incentivizing borrowers to return collateral or face liquidation.

Example lender story:

I want to deposit my ETH and BTC into the lending pool.

So that I can passively earn interest from borrowers.

I am aware that when the lending pool utilization rates are high, it might be challenging to withdraw my initial deposit.

I appreciate that I will earn higher interest rates during these times, incentivizing borrowers to return collateral or face liquidation

Scenario: Maria deposits 10 ETH into the lending pool. As borrowers use more of the pool’s assets, the utilization rate rises, making it harder for Maria to withdraw her initial deposit. However, she notices that her interest earnings have increased significantly. This incentivizes borrowers like John to return their borrowed assets promptly, ensuring that Maria can eventually withdraw her ETH.

Borrowers: Users who deposit ETH, BTC, ATOM (at an overcollateralized rate) and borrow from supply pools, accruing interest that can be paid back incrementally to unlock deposited collateral. If the value of the loan taken against the deposited collateral crosses certain safety thresholds, the collateral is put up for auction at a discount in return for the borrowed asset. This ensures that lenders are made whole and the system remains solvent.

Example borrower story:

I want to deposit my BTC as collateral.

So that I can borrow from the supply pool to fund my project.

I want to pay back the interest incrementally to unlock my deposited collateral.

I need to be aware of the safety thresholds to avoid my collateral being auctioned at a discount.

Scenario: John deposits 5 BTC as collateral and borrows 3 ETH from the supply pool. He plans to use the ETH for a short-term investment. Over time, John pays back the interest incrementally. However, when the value of his loan approaches the safety threshold, he receives a warning. To avoid liquidation, John quickly repays part of his loan, ensuring his collateral remains secure.

Liquidators: Users who provide collateral in exchange for discounted liquidated collateral. They help ensure the system does not accrue bad debt, where the debt exceeds the assets on hand.

Example liquidator story:

I want to monitor the protocol for collateral that crosses safety thresholds.

So that I can participate in liquidations and auctions.

I aim to provide collateral in exchange for discounted assets during liquidation events.

I expect to profit from purchasing these discounted assets and help ensure the system remains solvent by preventing bad debt.

Scenario: Jane, a liquidator, actively monitors the protocol for any collateral nearing liquidation thresholds. She spots an opportunity when John’s BTC collateral is about to be liquidated. Jane participates in the auction, providing the required asset in exchange for the discounted BTC. Because she acquires the BTC at a discount, Jane can later sell it at market price, securing a profit.

Key Liquidation Points:

Monitoring and Participation:

Jane uses tools and alerts to track the status of various collaterals within the protocol.

She participates in liquidation auctions as soon as collateral crosses safety thresholds to ensure she gets the best possible prices.

2. Profitability:

By acquiring liquidated collateral at a discount, Jane ensures that she can sell it later at a higher market price, making a profit.

The protocol’s design incentivizes liquidators like Jane to act quickly, maintaining system stability while also providing profitable opportunities.

3. Supporting System Solvency:

Jane’s actions help the protocol avoid bad debt, where the debt exceeds the assets on hand, by ensuring that liquidated collateral is promptly acquired and rebalanced within the system.

Liquidity Bootstrapping — Borrow & Supply Rewards

Money markets constantly balance the interests of suppliers and borrowers. If there are many suppliers of capital but no borrowers, there will be no yield to incentivize liquidity to stay. Conversely, if there are many potential borrowers but insufficient supply, borrowers will face high interest rates from high utilization rates (due to low liquidity), potentially deterring borrowing.

Traditionally, many money markets use supply-side incentives — rewards for users who provide liquidity for others to borrow. However, this can lead to situations where ample liquidity is available, but there are no borrowers to utilize it, resulting in the protocol bearing unsustainable incentive costs.

ShadeX introduces a novel approach by offering incentives to both the supply and borrow sides of the money market, paying borrowers to borrow during the bootstrapping phase. These incentives initiate a flywheel effect where supply is genuinely utilized, leading to higher yields that attract more lenders, creating better liquidity for borrowers and lower interest rates charged. This, in turn, boosts product usage as borrowers discover the benefits of both borrow incentives and sufficient available liquidity.

The combined supply and borrow side incentives will help ShadeX quickly achieve sustainability, ensuring a balanced ecosystem of real borrowers and adequate liquidity.

Encrypted Cross Margin Positions

ShadeX will leverage encrypted cross margin positions to give users maximum flexibility for the management of their positions — all while protecting the details of the users individual and aggregate data.

A cross margin position is a type of margin trading where the margin (collateral) in a user’s account is shared across all open positions. This means that the excess margin from profitable positions can be used to support positions that are close to liquidation. Here are some key points about cross margin positions:

Shared Margin: The entire account balance is used to margin all open positions. This allows for greater flexibility and can help prevent quick liquidations.

Risk Management: While it provides flexibility, it also means that a loss in one position can impact the entire account, potentially leading to the liquidation of other positions.

Liquidity: Cross margining increases a trader’s liquidity and financing flexibility by reducing margin requirements and lowering net settlements.

Offsetting Positions: Excess margin from one account can be transferred to another to satisfy maintenance margin requirements.

The use of cross margin positions on ShadeX will empower users to deposit multiple types of collateral while borrowing multiple different tokens, all aggregated into a single easy to understand position.

Encrypted Flash Loans

The world’s first encrypted flash loans will launch with ShadeX in Q1, empowering encrypted arbitrage strategies. Encrypted flash loans enable users to maintain their edge by exploiting price discrepancies across ShadeSwap without publicly exposing their strategies. These unique ShadeX loans also offer front-running protection — transparent DeFi leaves arbitrageurs vulnerable to front-running. Encrypted flash loans eliminate this risk, sparing users the need to invest time, money, and infrastructure in counteracting it.

Ultimately, encrypted DeFi reduces the cost of protecting transaction execution, leading to more accurate pricing and increased trading volume. This additional volume generates more fees, benefitting SHD stakers.

Collateral Swaps

Due to the cross margin positions, it becomes increasingly important for users to be able to dynamically manage their collateral composition backing their various debt positions. As an example imagine the following user:

Collateral →$10,000 BTC , $5,000 ETH, $1,000 ATOM

Debt → $5,000 ETH

Now, imagine this user is bearish on ETH and wants to change his $5,000 of ETH into ATOM. In the current money market paradigm, users are forced to withdraw their ETH → increasing their liquidation risk (as they are removing assets from their cross margin position). Once they withdraw, they can then swap on a DEX for the ATOM and then redeposit the ATOM into the cross margin position → reducing their liquidation risk.

ShadeX streamlines this process so users in a single transaction can withdraw collateral, swap their collateral on ShadeSwap, and then instantly redeposit their assets into their cross margin position.

ShadeX collateral swaps do all of this in a single transaction, ensuring users do not need to incur the risk of needing to temporarily increase their liquidation risk just to be able to modify your position! In essence, users are empowered to seamlessly modify their collateral portfolio on the fly.

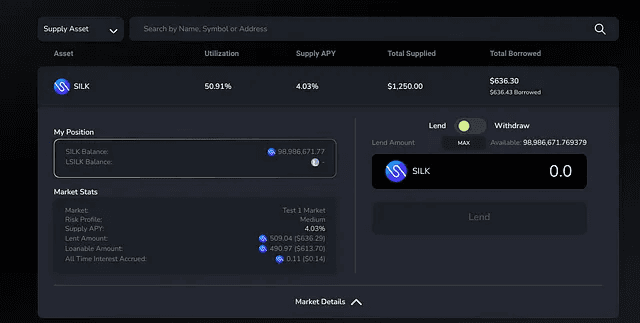

xTokens — Liquid Lending

ShadeX is a fundamental building block of encrypted DeFi, enabling users to operate freely while ensuring their data remains protected. One of the key components of ShadeX is xTokens — liquid tokens that represent a claim on a yield-bearing lending position. xTokens can be utilized in various DeFi applications as liquidity, collateral, or assets to be traded.

Imagine liquid staking your SILK (SILKy) to resist inflation while earning staking rewards. This dSILK can then be lent out on ShadeX, providing you with xSILKy, which earns both staking yield and lending yield. Assuming a 6% staking yield, a 5% outperformance of USD, and a 10% lending yield, you could potentially earn around 21% yield by holding xSILKy. Additionally, you can deposit xSILKy as liquidity on ShadeSwap, generating extra trade fees and LP staking rewards.

While these actions introduce additional DeFi risks, xTokens offer a vast array of financial opportunities, allowing power users to privately craft DeFi strategies that align with their desired risk profiles.

LP Tokens As Collateral

ShadeSwap has been in operation for over two years, facilitating over 1,000,000 trades and nearly half a billion in trade volume. Until now, liquidity providers on ShadeSwap have been able to earn trade fees and LP staking rewards. However, millions of dollars worth of this yield-bearing collateral face a tough decision. In money markets that accept LP tokens as collateral, liquidity providers (while retaining trading fees) must forgo the opportunity to earn LP staking rewards, which often provide a stronger incentive than trading fees.

ShadeX makes a significant advancement by allowing selected LP tokens to be used as collateral for borrowing other crypto assets on ShadeX while continuing to earn both trade fees and LP staking rewards.

This innovation drastically reduces the opportunity cost of leveraging LP tokens as collateral, transforming liquidity providers and DEX users into money market participants as well.

Here are some examples of potential LP tokens that might be accepted as collateral at the launch of ShadeX:

ATOM/stATOM

SILK/USDC.nbl

SILK/USDC.axl

wETH/wstETH.axl

sSCRT/stkd-SCRT

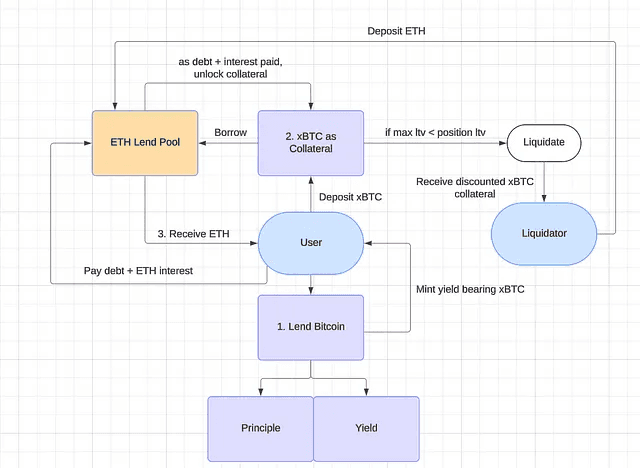

xTokens As Collateral

One of the collateral options on ShadeX allows users to use tokenized representations of their lent deposits as collateral for borrowing other assets. For example, a BTC lender receives xBTC and can deposit this yield-bearing xBTC as collateral, enabling them to borrow ETH against their lent BTC position. This schema empowers BTC depositors to passively earn yield while still using their valuable assets as collateral. This yield bearing xBTC could also be used to earn trading fees and LP staking rewards on a ShadeSwap pool.

Private Protocol Liquidations & Public Liquidations

When a borrow position reaches a critical threshold, where the debt significantly outweighs the value of the collateral backing the loan, ShadeX permits the position to be liquidated. The primary objective of liquidation is to ensure that lenders are compensated by enabling the free market to turn in the borrowed asset type to the lend pool in return for discounted collateral from the borrower (up until the borrower position is either solvent or fully liquidated). While the system aims to allow the liquidated borrower to retain as much collateral as possible, its main priority is to safeguard the interests of lenders.

ShadeX has two kinds of liquidations:

Encrypted Protocol Liquidations

Public Liquidations

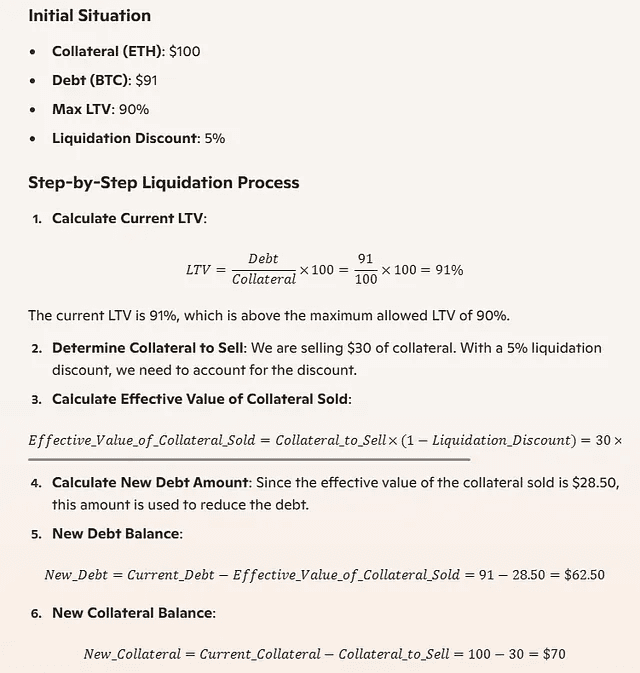

With the encrypted protocol liquidations, the protocol will steadily swap the liquidatable position’s collateral on ShadeSwap for the asset that was borrowed. This collateral is then returned to the lend pool, with the liquidation discount pocketed as protocol revenue. Here is an example:

In the above example, the protocol sold $28.50 of ETH collateral of the $100 of borrower collateral for BTC (keeping $1.50 as a 5% liquidation fee) lowering the LTV to 89.29% back to a safe LTV below the max allowable LTV. With protocol liquidations, these operations are broken up into small (encrypted) swaps to optimize and smooth out the liquidation.

Notably, this is the first time a money market protocol can do a liquidation operation this directly with a DEX as traditionally this type of swap could be front-run, bringing a large amount of risk such that a protocol would not be capable of performing this liquidation itself.

However, if the value of the collateral (ETH) backing the loan are dropping fast enough or if the value of the debt token (BTC) the liquidations, then the liquidation becomes publicly liquidatable where the liquidation opportunity becomes publicly visible for all users to interact with (ensuring that a buyer of the collateral is found).

ShadeX liquidations are ultimately a large revenue driver for Shade Protocol, while also serving as a keep solvency mechanism that protects lenders from an insolvent borrower position creating bad debt.

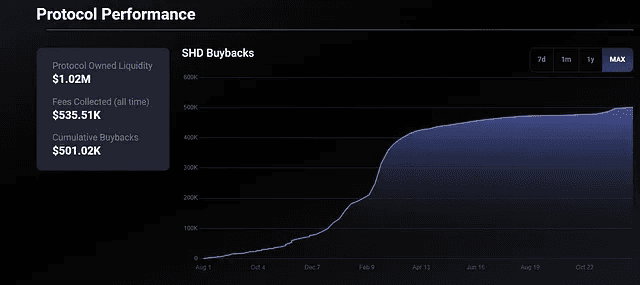

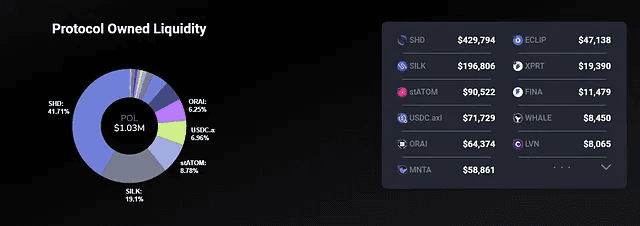

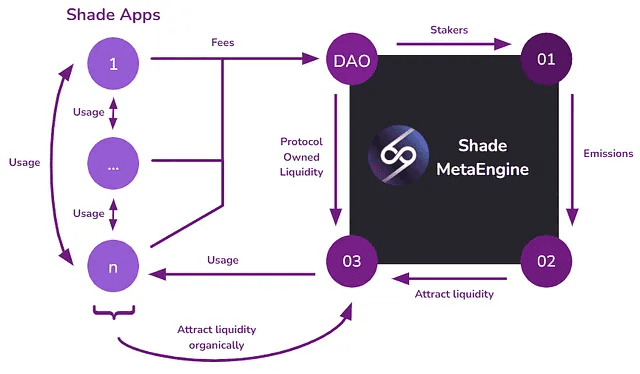

The SHD MetaEngine x ShadeX — An Interwoven Economy

DeFi to date is full of one off primitives (liquid staking tokens, perpetual swaps, spot markets, money markets, stablecoins) focused on purely their individual use case. Unfortunately, these DeFi building blocks when standing alone bleed a significant amount of value to other DeFi apps. A liquid staking token (for instance) has to spend money to grow liquidity for pairings on the DEX in order for the LST to be useful. In a similar sense, the LST needs money market adoption to unlock a host of additional use cases.

This fictitious LST that is generating significant revenue may find itself in a a painful situation where a large percentage of the protocol balance sheet must be invested into incentives into perpetuity. Stablecoin protocols suffer from a similar problem — needing to invest in liquidity & marketing across multiple platforms to even stand a chance within such a competitive marketplace.

Fundamentally, Shade Protocol aims to be a sustainable protocol where SHD token emissions drop to zero while in parallel generating significant revenue and growth. Shade Protocol combines a variety of protocol gathered fees which get repurposed in the form of protocol owned liquidity, and with the launch of ShadeX, protocol owned lending.

Because of the interconnected nature of Shade Protocol (spot markets, lending, borrowing, liquid staking tokens, stablecoins, staking, bridging, liquidity providing, liquidations) every $1 of activity creates a ripple of activity across the entire suite of encrypted DeFi products. As Shade Protocol grows its own permanently owned liquidity it will be slowly but surely transformed into a hyper efficient economy of both value created (for users) and value captured (a single unified DeFi protocol).

The following is a list of fee streams that are repurposed for protocol owned liquidity and staking rewards:

Borrower interest fees (ShadeX — NEW)

Flash loan fees

Protocol owned liquidation (ShadeX — NEW)

Open liquidation protocol fees (ShadeX — NEW)

Protocol owned lending generated fees (ShadeX — NEW)

ShadeSwap trade fees

SILK interest fees

SILK borrow fees

SILK borrower liquidations

stkd-SCRT mint/withdraw fees

dSHD mint/withdraw fees

dSILK mint/withdraw fees

Protocol owned liquidity generated fees

By continually expanding the economy of Shade and with continued protocol owned liquidity growth, the MetaEngine sets Shade up to attract organic sustained usage. This usage will continue to create better and better liquidity, creating an unstoppable black hole of liquidity tied to a suite of permissionless, globally accessible, and encrypted finance.

Finally, as more activity occurs organically across the Shade app, more of the fees are repurposed and converted to SHD → creating yield for SHD stakers (in return for their service of securing the underlying protocol).

Conclusion

ShadeX is not just a minor enhancement; it represents a transformative leap forward in the realm of encrypted DeFi. By introducing a suite of industry-defining features, ShadeX sets a new benchmark for privacy, security, and financial freedom in Web3.

With encrypted liquidation price points, lending, borrowing, deposits, and collateral swaps, ShadeX ensures unparalleled security and confidentiality in all financial interactions. This innovative approach protects sensitive data, fostering trust and confidence among users, and preventing market manipulation.

ShadeX redefines the DeFi landscape with the world’s first encrypted money market, addressing the critical flaw of data security in traditional money markets. By offering an environment where users can lend, borrow, and liquidate assets safely and privately, ShadeX mitigates the risks associated with targeted attacks and market manipulation. This positions ShadeX as a key player poised to capture a significant share of the projected $150 billion TVL global DeFi market by 2025.

As the platform scales, ShadeX aims to onboard billions in liquidity and attract thousands of daily active users who value privacy as a cornerstone of their financial strategy. The liquidity bootstrapping mechanisms, including borrow and supply rewards, ensure a balanced and sustainable money market ecosystem.

The introduction of encrypted cross margin positions and flash loans empowers users with greater flexibility and efficiency while maintaining data security. Collateral swaps allow for seamless management of collateral composition, reducing liquidation risks and enhancing user control.

Furthermore, ShadeX’s xTokens facilitate liquid lending, enabling users to earn multiple streams of yield while maintaining privacy. By accepting selected LP tokens as collateral, ShadeX minimizes opportunity costs and integrates liquidity providers and DEX users into the money market ecosystem.

The SHD MetaEngine interconnects various DeFi primitives within Shade Protocol, creating a hyper-efficient economy that captures and repurposes value across the entire ecosystem. ShadeX plays a crucial role in empowering the MetaEngine by introducing robust encrypted financial services that enhance overall liquidity and user engagement. This interconnected approach ensures sustained organic growth and an ever-improving liquidity pool, driving yield for SHD stakers and securing the protocol’s future.

In essence, ShadeX is not merely redefining money markets; it is shaping the future of private, decentralized finance. By continually expanding its encrypted DeFi suite and protocol-owned liquidity, ShadeX helps push Shade Protocol to new heights, positioning it as an unstoppable force in the world of permissionless, globally accessible, and secure financial services. This holistic approach ensures that Shade not only grows but also solidifies its standing as a leader in the DeFi space.

telegram - https://t.me/ShadeProtocol

app - https://app.shadeprotocol.io/analytics

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.