Greetings community,

Today we are proud to announce and highlight our incentive partnership with Stride - a Cosmos liquid staking solution. Stride prioritizes security, decentralization, and user experience. All things that Shade Protocol also values deeply within our product and community.

We look forward to deepening liquidity through this partnership with Stride, empowering opportunities for Stride users to leverage their liquid staking tokens on ShadeLend - a privacy-preserving lending platform that allows users to mint out Silk (a stablecoin) against their crypto collateral.

Partner Incentives

Dual incentives are officially coming to the SILK/stATOM pair. Users will have the opportunity to earn both $SHD, $STRD, ATOM staking yield, and trading fees for providing liquidity on this pair! The SILK/stATOM pair is differentiated from other liquidity pools because of lower potential impermanence loss due to SILK being a stable asset.

In addition to that, ATOM tokenholders do not have to choose between staking their ATOM or liquidity providing. Instead, via seamlessly buying stATOM on ShadeSwap or minting it on the Stride app users are able to liquidity provide and earn ATOM staking yield simultaneously using the stATOM liquid staking derivative.

ShadeLend X Stride Staking Derivatives

Using the power of Stride staking derivatives, users of ShadeLend can lock-up the following staking derivatives as minting collateral:

stATOM

stOSMO

stLUNA (soon)

stINJ (soon)

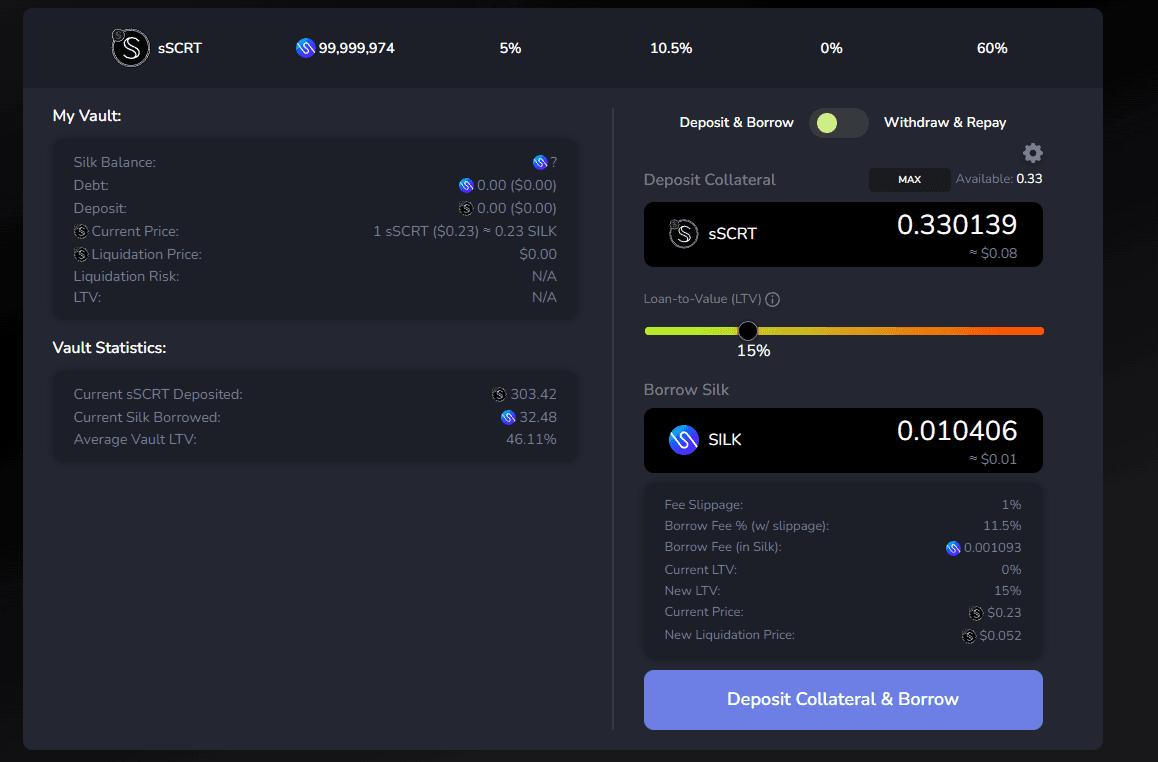

The beauty of this is that users do not have to forgo staking yield as they lock-up collateral to mint out Silk! This drastically improves the capital efficiency of borrowing SILK against collateral because staking derivatives are a yield bearing asset.

Users will be able to participate in two different types of DeFi strategies:

Leverage Liquidity Farming

Leverage Staking

Leverage Staking

Here is an example of leverage staking:

User bridges in 100 ATOM through the Shade App

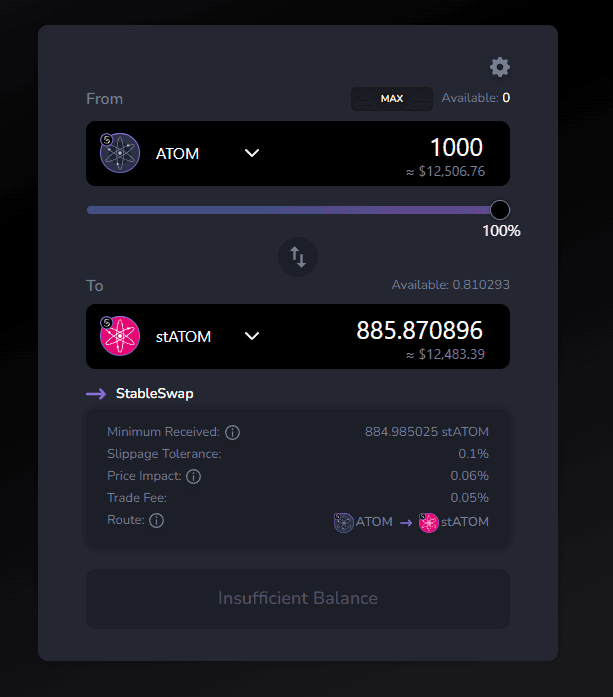

User swaps 100 ATOM for 97 stATOM on ShadeSwap

User locks up 97 stATOM in ShadeLend

User mints out 100 SILK using their yield bearing stATOM as collateral

stATOM as collateral is passively earning ATOM staking yield

User trades 100 SILK for 50 stATOM

In this scenario, the user is now earning yield on 97 stATOM locked as collateral as well as 50 stATOM acquired via borrowed SILK. If the user wanted to take this a step further, they could lock up their 50 stATOM and continue to loop their exposure to staked ATOM. The disadvantages of leverage staking is that there is potential for liquidation, as well as interest fees tied to each of the SILK borrowed against underlying collateral.

Leverage Liquidity Farming

Here is an example of leverage liquidity farming:

User bridges in 100 ATOM through the Shade App

User swaps 100 ATOM for 97 stATOM on ShadeSwap

User locks up 97 stATOM in ShadeLend

User mints out 100 SILK using their yield bearing stATOM as collateral

User swaps 50 SILK for 25 stATOM

User liquidity provides 50 SILK / 25 stATOM and begins accruing trading fees, ATOM staking yield, and SHD + STRD rewards.

Eventually, ShadeLend will support liquidity tokens as collateral on the lending product, unlocking additional liquidity and leverage capabilities for Cosmos assets.

About Stride

Stride's mission is to deliver the best and safest liquid staking experience to users in Cosmos. Stride allows you to stake and participate in DeFi.

Stride prioritizes the following three areas to ensure security whilst continuing to drive innovation:

Keeping DeFi safety top of mind. Always. Currently audited via Certik and Oak Security, two of the leading blockchain auditors. Stride also takes innovative measures with our governance modules and rate limiting to make sure stakers’ funds are secure.

Making stTokens the base tokens of Cosmos DeFi, with one-click integrations to money markets, DEXs and other existing Cosmos DeFi products.

Offering users an incredibly simple, vertically integrated App UX.

Conclusion

Shade Protocol is an ambitious array of application-layer products focused on a simple end user experience that involves the incorporation of privacy by default. These interconnected privacy-preserving DeFi products built on Secret Network will change DeFi as we know it — empowering the next generation of value creation and exchange. Shade Protocol is launching Silk: a privacy-preserving over-collateralized stablecoin pegged to a basket of global currencies and commodities, built on Secret Network.

Without privacy, DeFi is incomplete. Traditional financial markets offer a degree of privacy for users, and as a result offer up greater protections in some capacity than existing DeFi markets. Shade Protocol will be the world’s first truly cohesive decentralized and privacy-preserving financial applications — ushering in a golden era for Web3. Shade Protocol will always push for privacy by default, privacy as an expectation, and privacy as the key to unlocking the full value of a decentralized future.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.