Greetings community,

In the current iteration of transparent Web3, whether you are an individual or an institution your lending liquidation price points are completely visible. As a result, users are taking on significant risk from programmatic actors attempting to cause predictable cascading liquidations that guarantee profit.

What if we could recreate lending and borrowing markets, but with privacy that guarantees both fair and equitable protection?

Enter Shade Lend.

Private loan size

Private liquidation metadata

Private loan token (Silk)

Lend empowers users to seamlessly lock up their cryptoassets as collateral to mint out Silk, the flagship private stablecoin of Shade Protocol. With lend, user's liquidation price point is kept entirely private from the open market. In addition to this, the size of the loan is also kept private.

Shade Protocol benefits from Shade Lend usage as fees from borrowing and liquidations are redirected to the ShadeDAO.

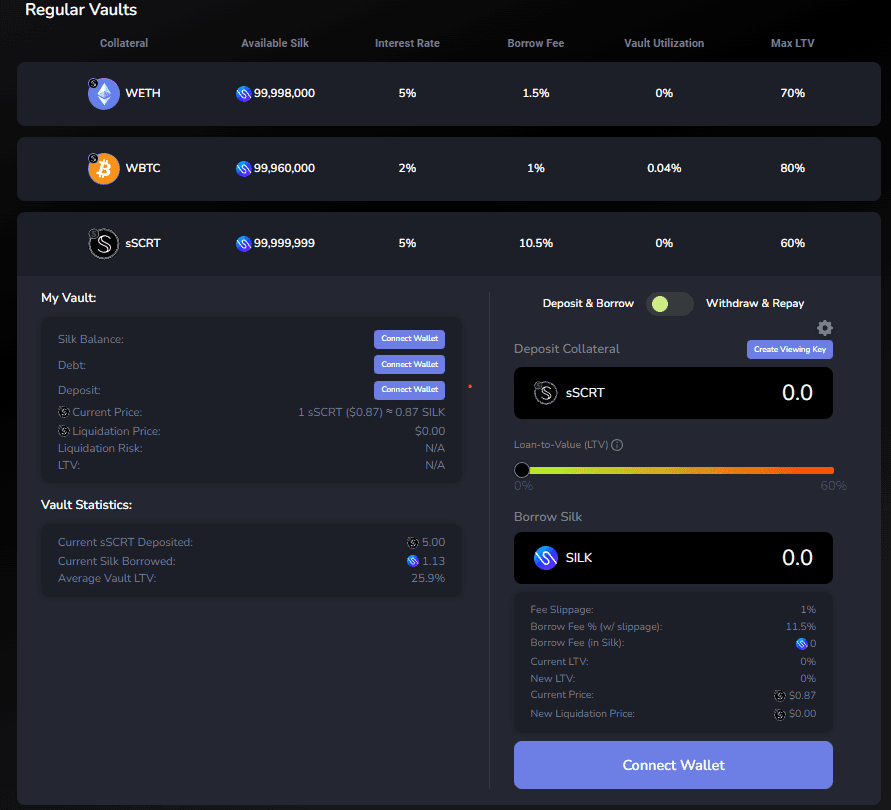

Vaults

Shade Lend has a variety of vaults:

Stablecoin

Staking derivative

Normal crypto token

Stablecoin vaults have efficient LTV (loan-to-value) ratios as stablecoins are excellent sources of collateral. Staking derivatives are another unique collateral which allows users to passively earn yield on the collateral that is passively backing the minted out Silk. Finally, normal crypto tokens (i.e. $ATOM, $SCRT, $ETH, etc.) have the most conservative LTV due to their volatile nature.

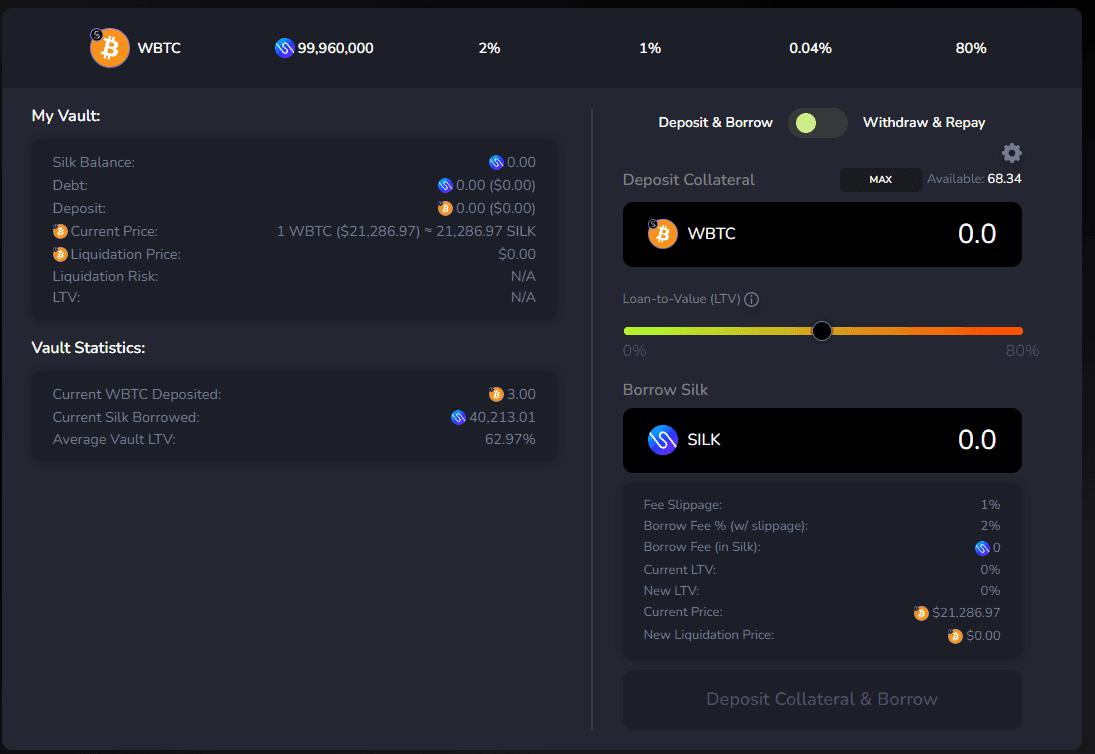

Borrow

On the "Lend" page, users can specify which collateral they wish to lock up, how much risk they want to take on, and how much Silk to mint.

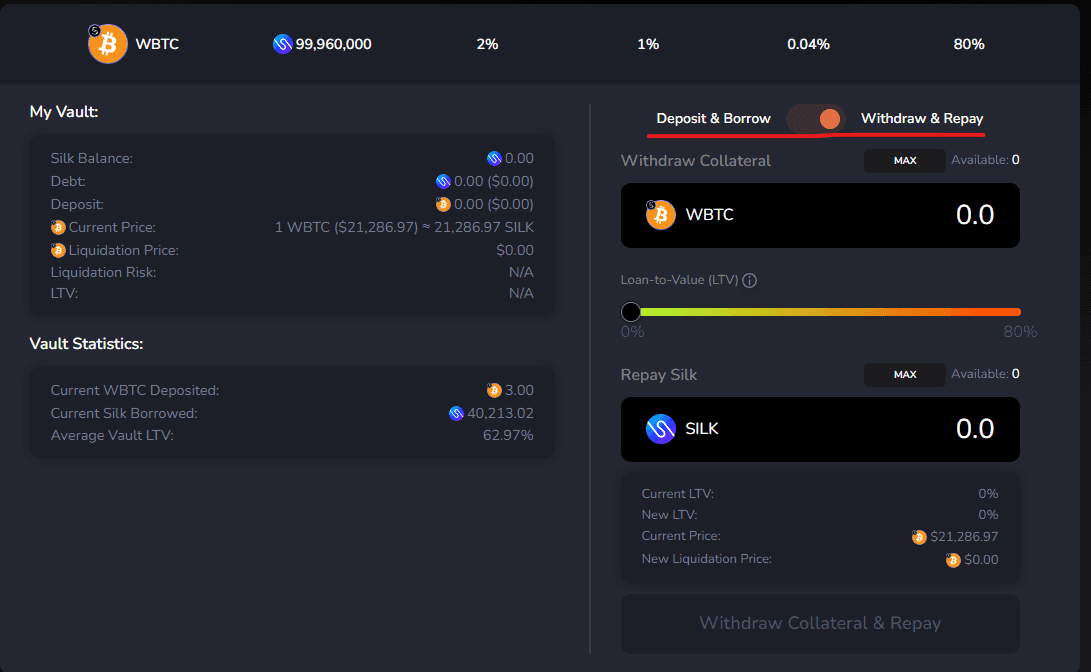

Users can always repay and lower their current LTV by paying off a portion of their loaned Silk by paying Silk back to the respective vault. We have simplified this experience by providing a simple toggle switch in the experience that allows users to stay on the same "Lend" page.

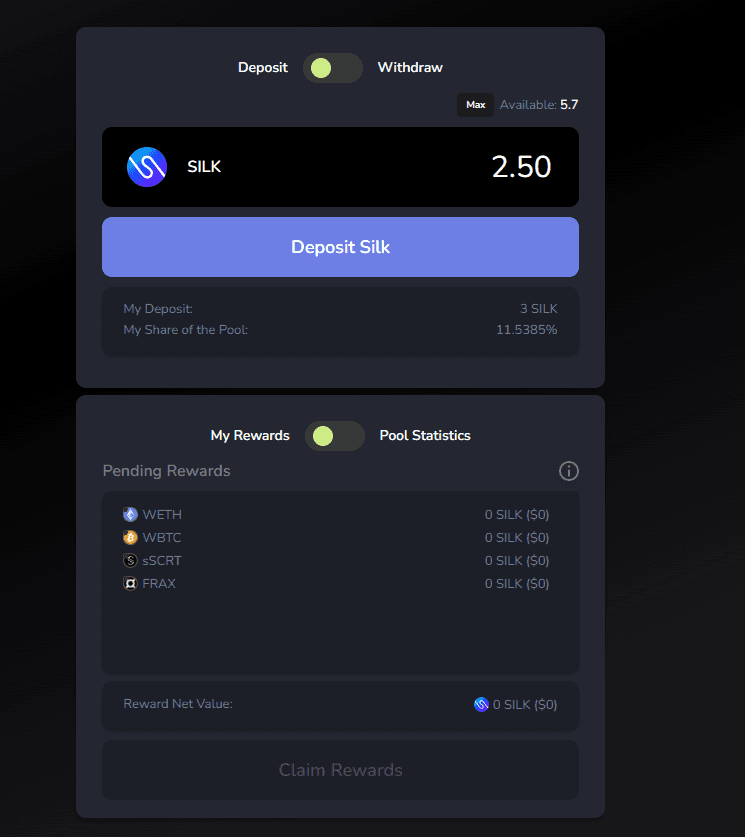

Earn

The Silk Earn pool empowers users to lock up SILK and earn from liquidated lend positions. In the earn pool, the protocol distributes liquidated collateral at a discounted rate to the Silk depositors. Passively earn yield with Silk - the more liquidation activity the more rewards for Silk Earn participants.

Shade will offer a variety of collaterals for users to earn:

stkd-SCRT

stATOM

stOSMO

stLUNA

IST

DAI

FRAX

USDC

Conclusion

Shade Protocol is an ambitious array of application-layer products focused on a simple end user experience that involves the incorporation of privacy by default. These interconnected privacy-preserving DeFi products built on Secret Network will change DeFi as we know it — empowering the next generation of value creation and exchange. Shade Protocol is launching Silk: a privacy-preserving collateralized, reflexive stablecoin built on Secret Network.

Without privacy, DeFi is incomplete. Traditional financial markets offer a degree of privacy for users, and as a result offer up greater protections in some capacity than existing DeFi markets. Shade Protocol will be the world’s first truly cohesive decentralized and privacy-preserving financial applications — ushering in a golden era for Web3. Shade Protocol will always push for privacy by default, privacy as an expectation, and privacy as the key to unlocking the full value of a decentralized future.

But we can’t do this without community. We need you to join our community and help make Silk and Shade Protocol a reality.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.