Shade Protocol is an array of connected privacy-preserving DeFi applications built on Secret Network. These key applications are stablecoins, governance, bonds, staking derivatives, insurance, synthetics, lending, DEXs, and more. Using the power of the Secret Network’s tech stack via secret contracts, all of the key Shade Protocol DeFi applications inherit the properties of programmable privacy.

All great innovations begin with difficult problems. Shade Protocol exists to solve the following (but not limited to) core problems that exist within Web3 DeFi:

● Transparent DeFi applications

● Fractured application-layer ecosystems

● Confusing user experience across multiple primitives

● Sovereign-currency pegged stablecoins

● Governance scalability

● Stablecoin stability

● Stablecoin legal landscape

Transparent blockchains make mainstream adoption difficult. Imagine a cryptocurrency user walks up to a ice cream shop. The user purchases an ice cream cone with a transparent stablecoin (such as DAI or UST). Perhaps the user even uses Bitcoin. Due to the transparent nature of these ledgers, the ice cream employee could see your entire crypto balance, and every transaction you have made since the beginning of time. In the world of Web3, everything is immutable. In that sense, privacy is even more important in Web3 than it is in Web2.

In other words, privacy is the final missing piece of the puzzle to bridge blockchain to our everyday lives.

However, privacy is often seen as dangerous. Cryptocurrency that exists with a Blackbox can be seen as negative — something to be avoided. Enter Secret Network with its viewing key architecture. Viewing keys on Secret Network are a cryptographic proof that allows a user to view their own encrypted balance and transaction history on the Secret Network blockchain. Users have the opportunity to hand off their viewing key to an auditor or government entity to allow themselves to be audited — this entity can then decrypt the transactions. Simultaneously, for everyone else in the world without the viewing key, the data remains encrypted on-chain and the user’s privacy is preserved.

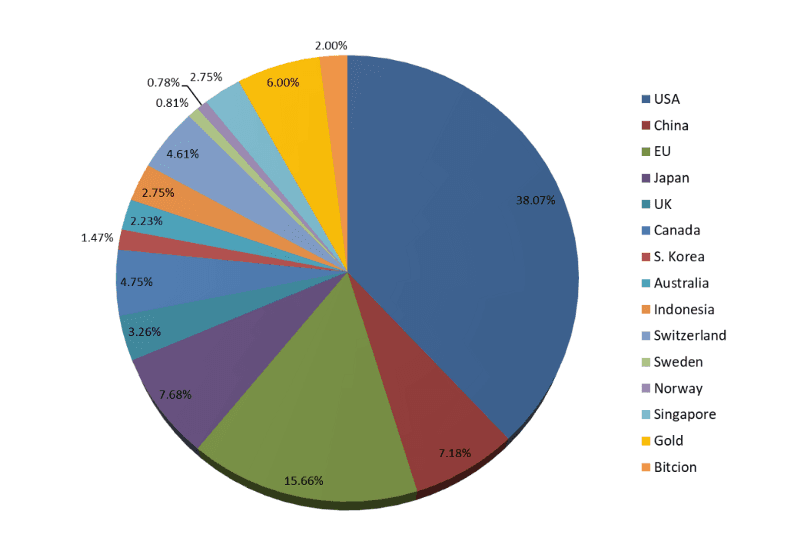

Shade Protocol uses the power of viewing keys with both Shade ($SHD) and Silk ($SILK), the two primary tokens of Shade Protocol. SHD is the treasury, governance, and revenue share token of Shade Protocol. It is used for staking, governance proposals, liquidity providing, transactions, bonds, and more. SILK is the privacy-preserving stablecoin of Shade Protocol. SILK is pegged to a basket of global currencies and commodities, including gold, Bitcoin, USD, Euro, Yen, and more.

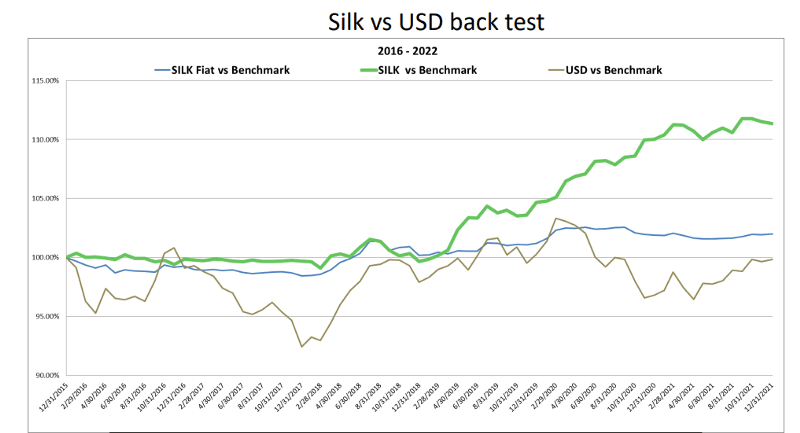

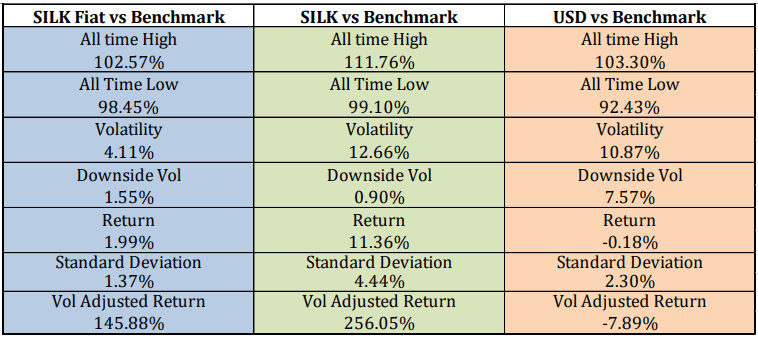

Special thank you to the peg-research team led by the Shade Protocol community discord. This data was provided by them, and the peg is ultimately still subject to changes based on their additional back-testing.

Silk

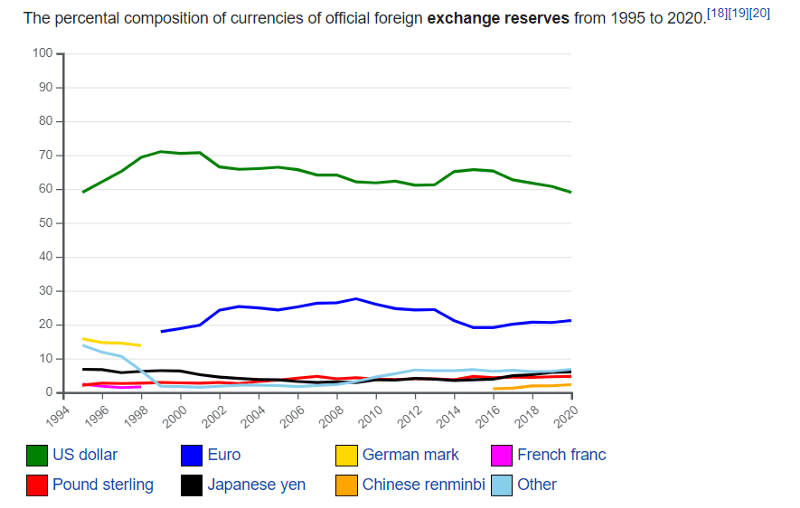

To date, the vast majority of stablecoins take the form of a USD pegged stablecoin. It is critical to note that the US dollar continues to lose both global marketshare as well as purchasing power.

How can we say that stablecoins are decentralized if they are pegged to a centralized monetary system? Shade Protocol set out to build Silk into the following:

(1) Privacy-preserving

(2) Auditable

(3) Perpetual hedge against global volatility

(4) Decentralized

(5) Modular

(6) Stable

(7) Fast

Silk will allow everyday people to interact with merchants and platforms around the world with privacy-preserving & simultaneously auditable transactions that take~6 seconds to execute on Secret Network. Silk is decentralized, and uses a modular stablecoin model focused on overcollateralization, but instead of being pegged to the dollar, Silk is instead pegged to a basket of currencies and commodities that function as a perpetual hedge against global volatility.

Credit: Shade Peg Research Team

Credit: Shade Peg Research Team

With Silk, parents and institutions alike no longer have to mess with foreign currencies markets to attempt to hedge against their own respective sovereign currency. Businesses can simply hold Silk, and settle instantly in the respective foreign currency as needed.

Importantly, Shade Protocol governance has the ability to vote and update the weights and currencies/assets that are part of the peg. This gives Silk the ultimate flexibility with navigating a changing global environment. Silk is perfectly positioned to adapt to changes over the next 100s of years — empowering $SHD holders to determine the future of currency.

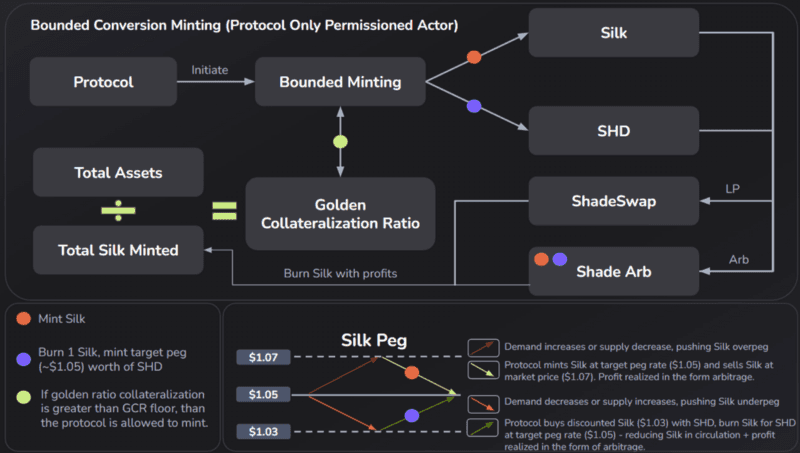

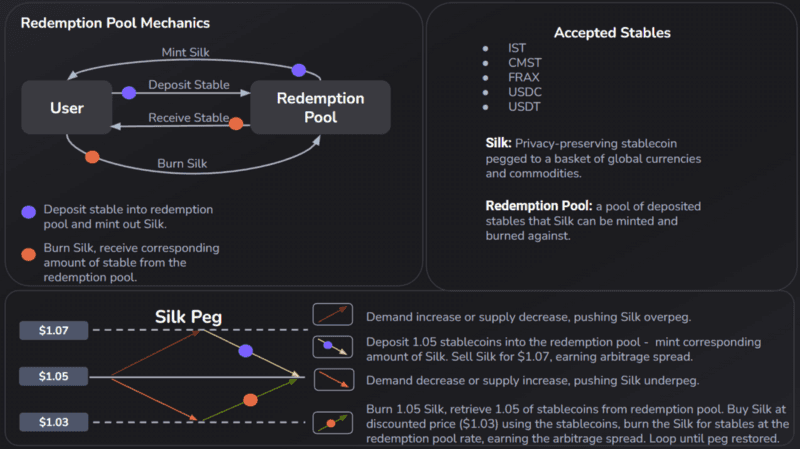

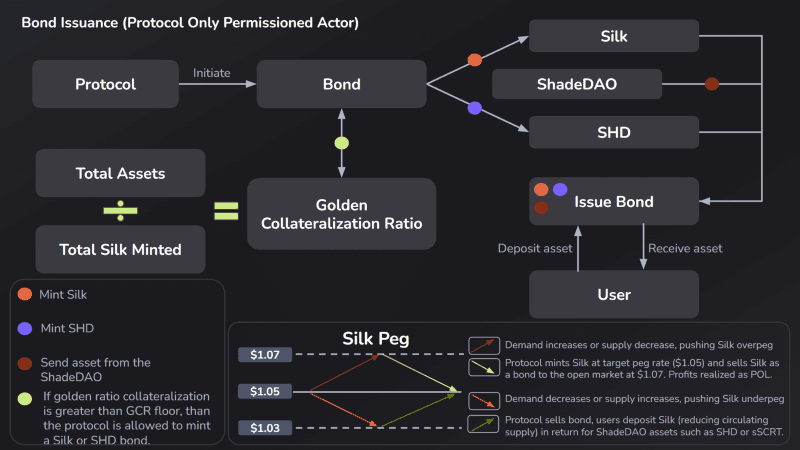

Silk’s peg is maintained by a system of arbitrage that occurs whenever the secondary market is trading at a price above or below the target Silk peg price.

Application Layer Ecosystem

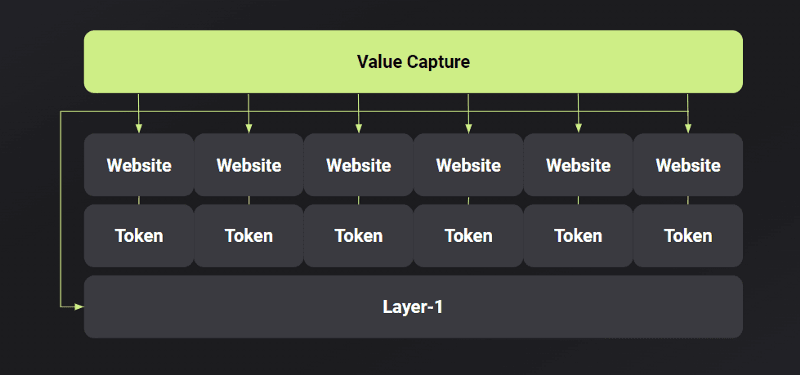

To date, the vast majority of Layer-1 protocols have unique application tokens per DeFi primitive. This unfortunately enables the following problem:

(1) Fractured value capture

(2) Confusing end-user experience

(3) Separated application experiences

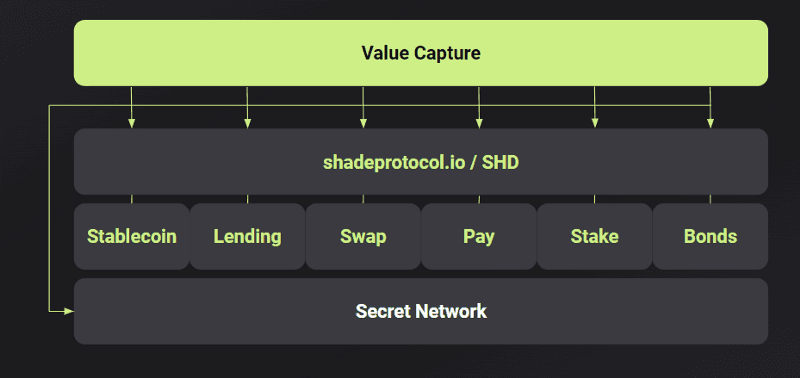

Shade Protocol aims to solve the fractured application layer problems by build a cohesive set of DeFi primitives that follow a simple principle:

No new unique application tokens per application.

As Shade Protocol launches other key primitives (staking derivatives, bonds, lending, insurance, synthetics, DEXs, etc.) there will not be new tokens launched with these primitives. Instead, 100% of the revenue streams will be returned to the Shade Treasury as well as to Shade stakers. Talk about value accrual! Additionally, all of these primitives will live in the same portal on the Shade Protocol website. Imagine a unified user experience — all of the DeFi tools you have come to know and love all living in the same simple UI/UX mobile and web experience. All with privacy by default. All accruing value toward the Shade Protocol community.

Revenue Streams

In order for a protocol to be sustainable, it must receive tangible economic fees tied to utility that end users sustainably desire to use. Shade Protocol will have the following revenue streams enabled:

(1) Silk transaction fees

(2) Silk ← →SHD conversion minting fees

(3) 10 years of SHD staking rewards

(4) Shade Treasury L1 staking rewards

(5) Shade Treasury LP participation rewards

(6) stkd-SCRT liquid staking derivative fee stream

(7) stkd-SHD liquid staking derivative fee stream

(8) Synthetic conversion minting fees (future)

(9) Stabilizer token airdrops (future)

And this is only the beginning. As more key DeFi primitives are created, more tangible economic accrual streams will be captured and returned to SHD stakers and tokenholders in the form of either (1) Rewards (2) Buybacks.

Governance

One of the core problems that exists within DeFi is the problem of governance and treasury management. As Shade Protocol’s treasury grows, the amount of flexibility and yield bearing opportunities will continue to grow — as will the human capital needs in order to scale the protocol.

What are the core needs of Shade Protocol from governance?

(1) Flexibility to manage and grow the Shade Treasury

(2) Avoid centralization of management of the protocol

(3) Multiple different components of Shade Protocol require different ranges of expertise and background

(4) Need tokenholders to have the ultimate authority over Shade Protocol and anyone that represents token holders

Shade Protocol governance consists of three different components (1) Token holders (2) Representatives (3) Branches. Branches are multisig with X amount of addresses that have control over Y amount of parameters and can take Z specific actions. Branches can be created by baseline tokenholders, with regular elections in place to modify entities that exist within the branch. When branches perform an action, a sanity check is distributed to baseline tokenholders to approve the action. Sanity checks require extremely low quorum. As a result, everyday transaction of the branches should largely go unheeded (important for flexibility and growth), but if there is ever a nefarious action the baseline tokens holders can veto the action and initiate a re-election of the multisig.

More than likely there will be multiple branches devoted to different components of scaling Shade Protocol: Silk, Treasury Management, HumanDAO, Grants Program, and more. Representatives are simply an address that has SHD votes delegated to it. Any SHD stakers can contribute their vote to any address. Representatives are not economically incentivized as they perform purely a public good of voting on proposals. Users can always vote on their own, and can always vote separately from the vote of a representative.

By leveraging the power of branches and representatives, Shade Protocol will be able to scale itself rapidly, while still holding end responsibility and accountability squarely in the hands of SHD stakers.

Legal Landscape

Stablecoins tied to individual sovereign currencies run the risk of a greater amount of legal scrutiny because of the derivative nature of the stablecoin. The nature of the scrutiny is tied to how large capital concentration on a derivative layer of a sovereign currency (in the form of a stablecoin) can negatively affect said sovereign currency stability and monetary policy. That is to say, stablecoins add additional risk to fiat systems because central banks no longer have 100% direct control over a portion of supply generation and contraction.

Additionally, reserve backed stablecoins run the risk of directly impacting macroeconomics if enough liquidity is concentrated within these reserves as opposed to other key components of fiat distribution. Silk is uniquely positioned because it is neither a reserve currency, nor is it directly tied to a single sovereign currency.

Because Silk is not directly pegged to any given sovereign currency, it lives firmly outside the majority of regulatory scrutiny as Silk is not an underlying fiat derivative. Silk aims to be a hub and facilitator for global transactions, and does so with a level of neutrality and decentralization that is novel within Web3. However, while Silk is uniquely positioned with the above features, there will inevitably be scrutiny surrounding the following variables:

● KYC/AML/Cybercrime

● Tax Compliance

Silk is well positioned for scrutiny under the following:

● Safety, efficiency, and integrity of the payment system

● Data privacy, protection and portability (unique to Silk)

● Sound governance, including the investment rules of the stability mechanism

● Market integrity

● Auditability and compliance via viewing key structure on Secret Network

Conclusion

Shade Protocol is an array of privacy-preserving DeFi applications built on Secret Network. As blockchain becomes more integrated into our everyday lives, the need for a cohesive and auditable privacy-preserving DeFi ecosystem will emerge as an absolute power house and requirement to bring in the next stage of institutional and retail adoption. Ultimately, privacy is the key to unlocking the full value of a decentralized future — and Shade Protocol is perfectly positioned to help unlock this value.

The age of globalization is being accelerated as a direct result of Web3. Now more than ever, the need for a stablecoin that does not inherit the risks of any single sovereign fiat is key. Also, because stablecoins to date are derivatives of individual fiat systems, they add additional risk to those existing economies. Silk is the solution — a globally distributed stablecoin pegged to a basket of currencies and commodities. Silk serves as a lucrative settlement layer for transactions of every kind, Silk as a currency is more resistant to volatility and monetary policy than any stablecoin to date due to the design of Silk basket. Finally, Silk is uniquely positioned as neither a derivative stablecoin nor reserve currency, giving a distinct path to compliance and regulatory freedom within the existing international cryptocurrency and financial regulatory framework.

Finally, Shade Protocol and its principles of cohesiveness and value capture bring a level of stability and unified user experience that will ultimately make it a powerhouse within the world of DeFi protocols. With flexible and scalable governance as well as a clear roadmap for more Shade Protocol primitives, explosive growth is on the horizon.

What’s Next?

This exciting milestone of getting SHD into the hands of the community carries forward our momentum from our initial announcement of Shade Protocol in September 2021. With more key primitives being funded and built, more community members getting involved with Shade Protocol, and more supporters and partners than ever helping to ensure our global growth, the future has never been brighter for Shade Protocol and Silk.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.