Any asset can go to zero.

That’s the first rule of crypto; however, it’s also the first thing everyone forgets when they fall in love with a new asset. “But not $MYBAG…”, some will protest. Ok, fine. But there is one sacred sphere of crypto where we must listen to the first rule or face dire consequences: stablecoins.

Stablecoins only store real value if they are “backed”.

It follows logically that how and what you back an asset with are enormously important. Ultimately, the stability mechanisms and collateral used to back a stablecoin become part of its respective risk profile. Because, as we all know from the scars of May 2022… any asset can go to zero.

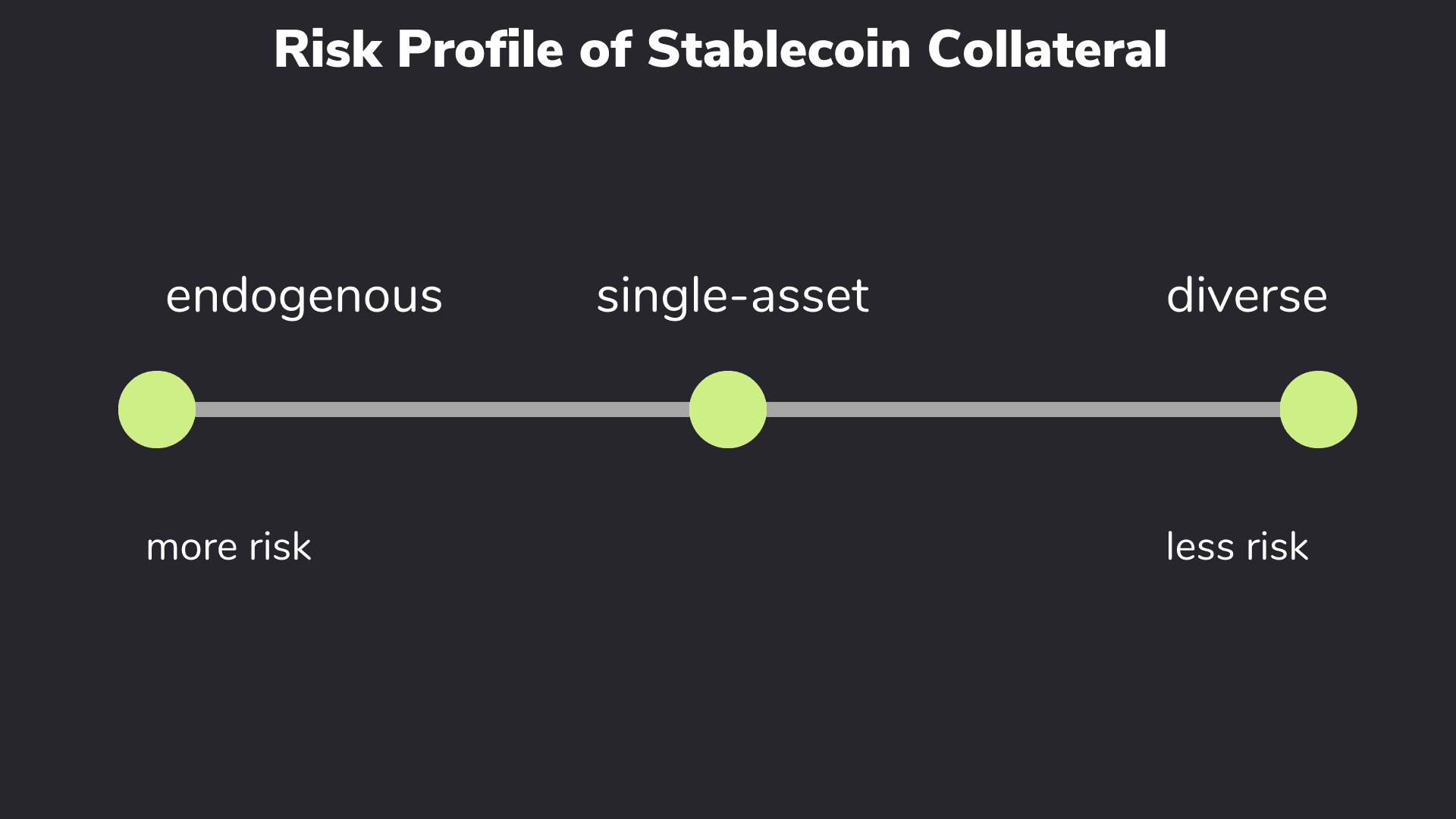

This is a brief guided tour of the spectrum of risk associated with stablecoins and their underlying collateral. We’ll take a look at both Ethereum stablecoins and Cosmos stablecoins using this risk spectrum and see how they measure up.

Endogenous Backing/Collateral

Understanding the core attributes of the collateral backing of stablecoins ultimately helps users understand the core risks associated with each respective type of algorithmic stablecoins.

“Endogenous”, “self-referencing”, and “circular”collateral are terms used to describe the assets that back algorithmic stablecoins. If an entity issues both a stablecoin and a token that backs the value of the stablecoin, the ice starts to get thin.

If the proposed House Stablecoin Bill goes anywhere, it would place a two-year ban on stablecoins backed only through endogenous collateral. The proposed legislation was birthed out of the $60B collapse of LUNA and UST. This model was the paragon of endogenous backed stablecoins. Users could burn LUNA to mint UST and visa versa. (If you’d like to hear more about why this was so dangerous in retrospect, watch Shade’s Lead Researcher offer a detailed analysis here, 15min video)

Today, the Ethereum stablecoin FRAX operates with a much safer hybrid model. You can mint FRAX via algorithmic/endogenous means (FXS, Frax Shares) or via exogenous collateral (USDC). The FRAX team has worked to mitigate risk associated with either of these single approaches by splitting the difference and adopting both. They limit the vulnerability of FRAX only being backed by their governance token (FXS) by also having USDC as a backing.

Single-Asset Backing via Exogenous Collateral

Many prominent stablecoins are directly backed by fiat currency, often the US dollar. USDC and USDT are bound to play by reserve attestation guarantees which, theoretically, ensure that every coin corresponds to USD sitting in a vault. These are not collateralized of course. Just backed via reserves.

For the best-known decentralized and overcollateralized stables, we can start on Ethereum with DAI and RAI. Both are minted by providing ETH at an overcollateralized ratio. What that means in simple terms is that you would give $150 of ETH as collateral to get $100 worth of DAI. This ensures that if ETH’s value tanks by 50% your DAI is still worth $100. There’s more to it, but that’s the basics anyway.

Right now, DAI is the 4th largest stablecoin by market cap, and the largest decentralized stablecoin by market cap. But let’s revisit the first rule of crypto. Do you believe that Ethereum could go to zero? Is that possible in 5 years? 30 years? 100 years?

From the standpoint of risk mitigation, a more cautious approach would dictate that we collateralize with multiple assets. Just within the last year, Maker DAO now offers collateralized DAI minting with wBTC.

If it is true that anything can go to zero, protocols can and should seek to minimize their risk exposure by changing how and what they collateralize. By choosing multiple “anchor” assets to collateralize their respective stablecoins, protocol’s can lower their cumulative collateral risk more than single-asset collateral backing.

Diversified Exogenous Collateral

Cosmos DeFi is a thrilling frontier right now, and Cosmos stablecoins are a big part of that landscape.

Many projects are looking to diversify collateral. The fundamental approach is to mitigate risk by not allowing any single asset to dominate the collateral for a stablecoin.

IST (Interchain), and USK (US Kujira)

IST (Interchain stable by Agoric), can currently be minted with USDC, USDT, DAI, or ATOM. Going forward, Agoric's Economic Committee will evaluate particular assets, collateralization ratios, and associated risk when evaluating what may back IST in the future.

USK (from Kujira) is collateralized by a wide variety of assets including ATOM, stATOM, ARB, wAVAX, wBNB, wBTC, DOT, wETH, wstETH, wFTM, INJ and more.

SILK

SILK is the first-ever private stablecoin pegged to a basket of assets and commodities. Within just one week, it became the largest decentralized stablecoin in the Cosmos ecosystem.

It's peg composition is more stable than any single currency and is flexible via Shade Protocol (SHD) governance. How is it collateralized?

SILK is currently collateralized by wETH, wBTC, stATOM, stkd-SCRT, stOSMO, and stables like USDC and USDT. The mechanisms for this backing are redemption pools and overcollateralization.

The team and the community will continue to open additional minting vaults with high quality assets. Jump into Telegram or Discord to participate in these conversations!

It is possible for some algorithmically backed Silk to exist in circulation while maintaining system solvency (known as Bounded Conversion Minting). The protocol is the only entity that can perform BCM and is only permissible under strict mathematical circumstances detailed in the whitepaper.

The Future of Stablecoins

The power of crypto is that each user can define their preferred risk profile. That reality holds true for stablecoins.

Much of the innovation happening around stables involves a lower risk profile accomplished by diversified backing.

Everything we’ve learned about crypto up to this point has been trial and error. There must be more trial and error to keep moving forward. We can either settle into the status quo or tune into what’s happening on the frontier of DeFi.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.