There's a hurdle that everyone must overcome in order to fully understand Silk. It’s a deceptively simple question:

How can small doses of volatility be baked into something “stable”?

Since Silk’s peg (and by implication market price) floats over time, does it really fit the definition of a stablecoin? More than that, does this character undermine its ability to achieve widespread adoption as transactable money?

This question strikes at the heart of a growing chasm between two diametrically opposed definitions for “stable”. And as we follow this inquiry with honesty, the red thread of reason leads us to a surprising decision. It's another classically crypto“red pill vs. blue pill” moment in the way we think about stable assets.

Two Definitions of Stability (but one is an illusion)

Here’s the choice. Would you rather have

something that stays the same price but functionally loses value over time due to inflation, or

something that slowly appreciates in price over time in order to preserve purchasing power

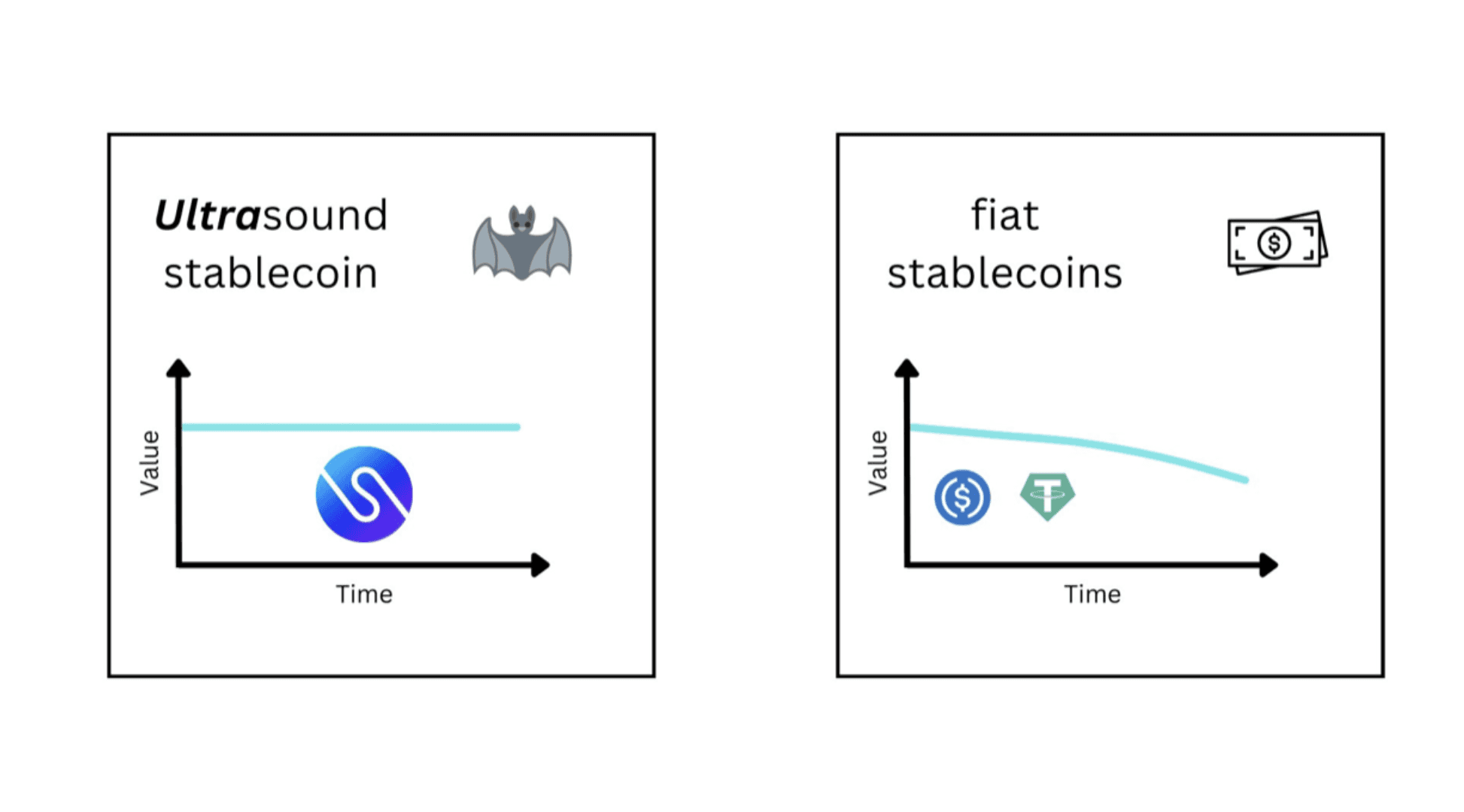

Option #1 describes fiat-pegged stablecoins (like USD or EURO). Price stays the same over time. Is that stability?

Option #2 describes the essence of a growing camp of inflation-resilient stablecoins like Silk.The price appreciates relative to single currencies in order to preserve purchasing power. Is that stability.

The Allure of Embracing the Illusion

If you’ve seen the Matrix, you remember the scene where Cypher is preparing to betray his tribe. His negotiated price? Wealth in the matrix.

He shares a celebratory dinner - in the matrix - with the baddies to seal this betrayal. He pauses to study a bite of his steak and reflects:

“I know this steak doesn’t exist… But ignorance is bliss.”

You could say the same thing about the US dollar. What the dollar was, what the dollar used to represent… it no longer exists. It’s been hollowed out. Like the matrix, the story of the world the dollar presents to us is illusory.

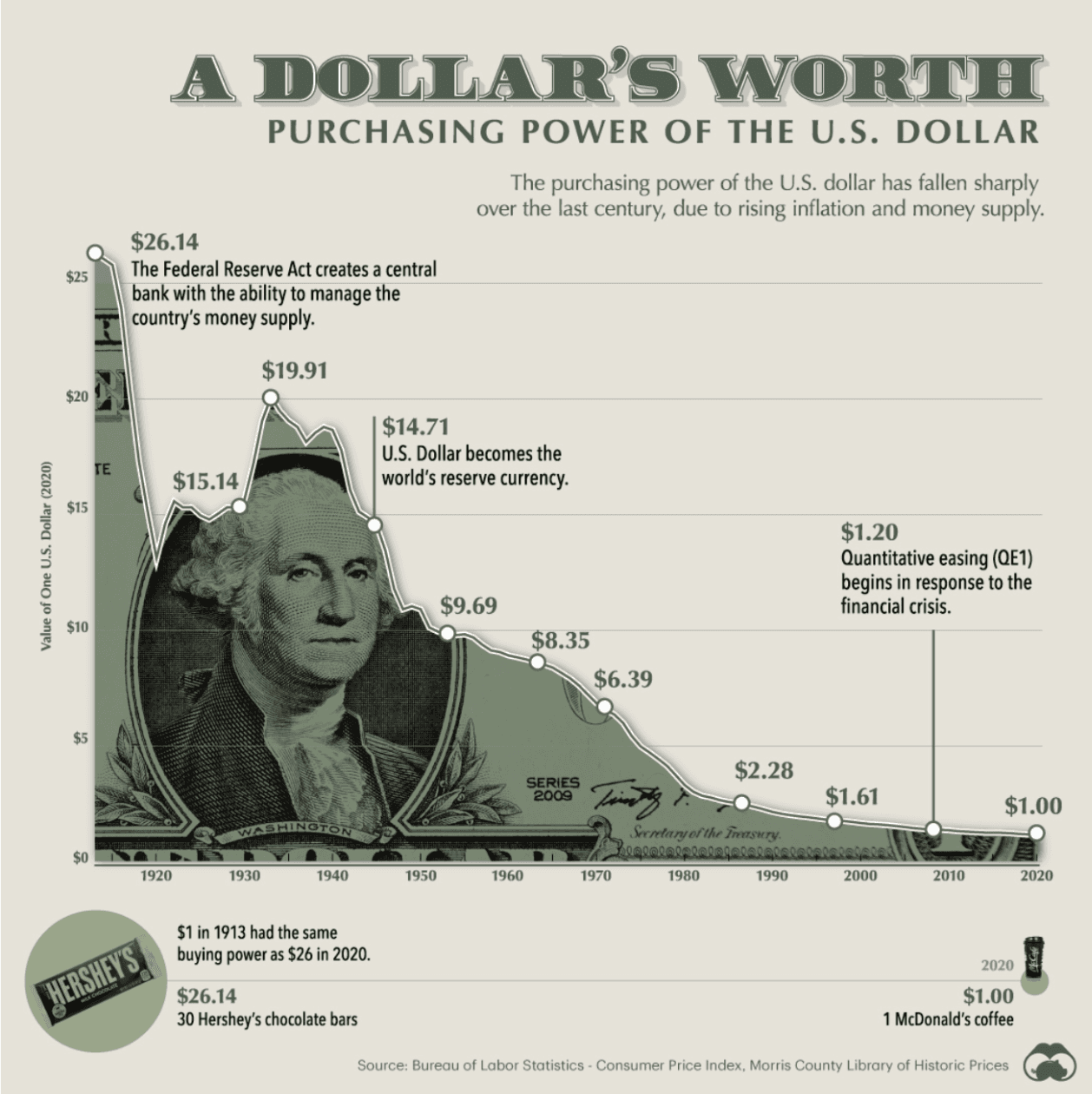

The dollar is down ~25% in real terms since 2020. And You’ve already seen charts like the one below that depict what has happened to the dollar’s purchasing power over time.

The story about the dollar’s purchasing power is obvious to everyone. It’s the tip of the iceberg. But what’s the rest of the iceberg look like?

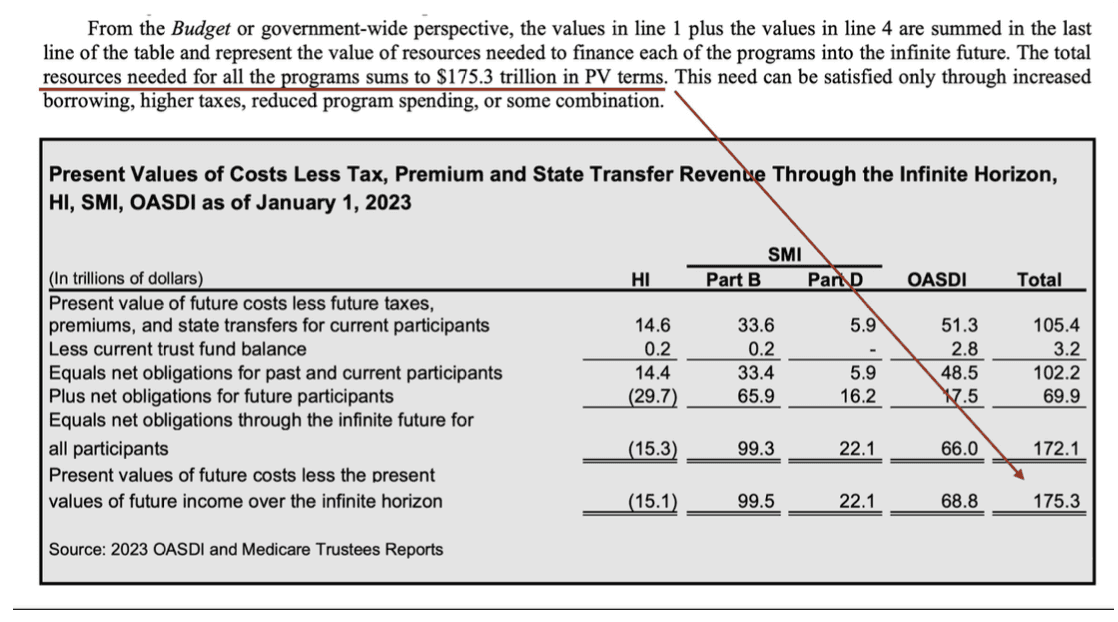

US liabilities are $175 trillion.

It’s a figure so mind-boggling, that it defies imagination.

But this story has already happened before. The only play in the playbook has already played out in times past. What does the

US do with that overwhelming debt? What is the only thing the US can do?

Print.

And you know what that means. What we’ve seen in the last four years is just a preview.

Like Cypher, we can sit in an illusory landscape and tell ourselves that “$1.00 is stability”. We self-soothe with the words: “I know that what this dollar represents doesn’t exist… but ignorance is bliss.”

Ignorance is only bliss until reality makes impact

If you were standing on train tracks and I told you that a train was coming with 175 cars behind it, would you say “ignorance is bliss?”

No amount of bliss could compensate for the impact of reality. A reality already chugging down the tracks with no rewind, no exits.

Dear reader, the intent isn’t to overwhelm or create fear. But we need to get on the right side of reality.

How can we support the claim that a stablecoin pegged exclusively to USD is stable?

If 100+ years of US financial history and another millennium of history on world reserve currencies definitively prescribe that $1.00 will be worth less in the future than it is today then why… why would we choose USD-pegged assets as a preferred mode of preserving purchasing power? Why would we crown them “stable”?

The Antidote for the Illusion

We’ve taken great pains to articulate the illusory definition of stability. So what’s the antidote? What is a better definition?

In an economic environment characterized by currency devaluation, precisely measured volatility is necessary to ensure the preservation of purchasing power. In other words, small doses of volatility are necessary to overcome the destructive power of fiat debasement.

That’s it. That is the reason that Silk’s peg is calibrated to appreciate over time. Silk’s design is to increase in price over long time periods relative to $1.00.

It makes sense, right? Because true stability means your purchasing power is preserved. Not “number stay same.”

If you’ve made it this far, you understand. You’ve seen just how deep this rabbit hole goes. And you have a choice.

You can go back to the world you’ve been programmed to see. Or you can take the antidote.

Ok, but will people actually be able to transact with Silk?

For the last few months, people have already been paying expenses with Silk all over the world. Through Fina Cash, users run a VISA card (from their phone) and the Silk is instantaneously sold for EURO and then swapped into the appropriate currency for the local market.

But the next theoretical level of Silk’s adoption is even more simple.

If Silk continues to grow, the next level of adoption is direct payment to a merchant. In other words, a merchant is actually accepting SILK directly on-chain.

But if Silk is $1.15 in August and happens to be $1.16 or $1.14 the next month — or even the next week, would a merchant really sign-up for that?

It’s the biggest question.

Users, merchants, enterprises, DAOs, governments, hedge funds will accept a small dose of volatility when they understand the alternative.

These entities will embrace the antidote when they have seen the illusion.

But how many will choose the illusion? How many will accept the antidote? We don’t know.

It comes back to a very, very simple choice. Which type of “stable” asset any user or entity trusts for stability depends on the operative definition they choose for “stable”.

Do you want $1.00 or do you want purchase power preservation over time?

We can’t accept both definitions as trustworthy.

The most honest approach to stable asset design

Users may find valuable use cases for USD-pegged stablecoins in their personal financial strategies. The free market will decide on this it always has.

But holding a USD-pegged stable as part of your portfolio should be done “on purpose” not “in ignorance”. And you can make a strong case that right now, the market is dining on steak with Cypher.

It’s a choice we can all make, isn’t it? We can wake up in bed and forget what we’ve seen.

But it’s dishonest. It’s disconnected from reality.

That’s not where Silk wants to live. Silk was born in the rabbit hole and is, in that way, the most honest approach to stable asset design given the illusory nature of our monetary landscape.

So… we have to ask:

Do your perceptions and subsequent decisions about stable assets belong to you, or are they part of the illusion?

Because make no mistake, the illusion is real…and so it the antidote.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.