In this blog post, we will outline the Shade MetaEngine - a novel architecture that intertwines public goods and protocol levers to achieve economic sustainability and growth for Shade Protocol. The inception of the MetaEngine principles began in 2021 based on a simple theory:

Isolated public goods will struggle to achieve sustainability within a DeFi landscape that prioritizes growth at all costs.

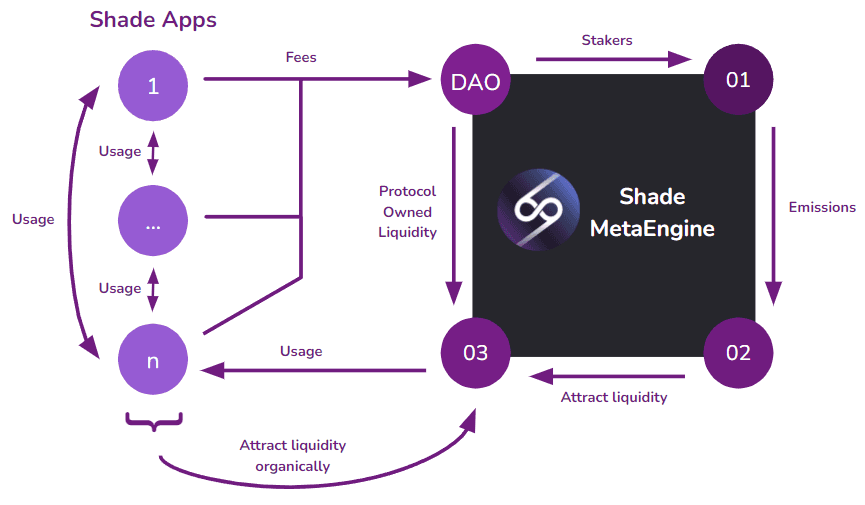

Enter the Shade MetaEngine - a financial system with a superset of self-referential applications sharing value accrual, governance, and interconnected financial functions under a single overarching token that governs Protocol Owned Liquidity (POL) and fees.

The roll out for the MetaEngine will begin with the launch of Shade staking.

DeFi Sustainability Problems

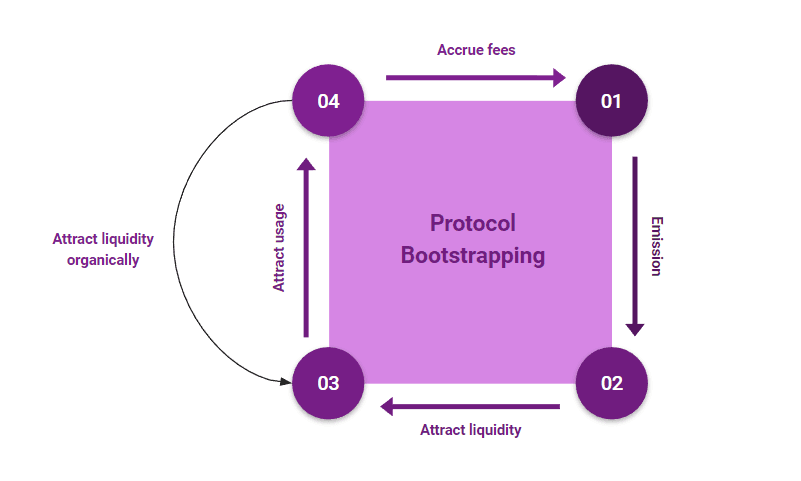

To date, the vast majority of DeFi projects are in a race to bootstrap large enough user bases to eventually lower emissions and enter into a phase of real sustainability. These DeFi projects typically have singular use cases, and they are forced to emit value at external platforms or partners in the hopes of eventually achieving sustainability.

On a deeper level, bootstrapping liquidity for an isolated product amplifies the need for protocols to compete on emissions. In the absence of true innovation, APR is their main source of differentiation. Attracting users and attention through economic incentives alone is an unsustainable path plaguing many projects.

Protocol bootstrapping has additional complexity due to the opportunity cost of capital. If a user can earn 10% yield to LP an ATOM/stATOM pool on another platform, then a new protocol will need to provide a yield greater than or equal to 10% during the bootstrapping phase in order to offset the opportunity cost that the capital could earn elsewhere. The emissions bootstrapping race competes on APR to attract liquidity - increasing opportunity costs for users, and pushing other protocols toward high inflation.

It's expensive to attract the necessary liquidity and usage which converts into organic liquidity - especially when simultaneously being reliant on third party platforms and competing with unsustainable opportunity costs.

In addition to the bootstrapping problem, DeFi ecosystems struggle from broader problems such as:

Silos of fractured liquidity

Fractured incentive structures across multiple public goods

Isolated UI/UX across multiple DeFi primitives - creating worse UI/UX

External dependencies that provide a broader attack surface

Shade MetaEngine

Enter the Shade MetaEngine - a series of connected public goods that use generated fees to reinvest into underlying public goods in a way that enhances the service provided to users while slowly lowering emission costs overtime. The key component of the Shade MetaEngine is every additional app enhances the system in terms of utility and/or shared liquidity. While many single purpose protocols focus on competing in a broader competitive market, Shade Protocol instead aims to make an entirely self-referential DeFi economy of interwoven applications where each $1 of activity creates a ripple effect across the entire set of Shade apps - all of which is captured and repurposed within the Shade MetaEngine.

The future of Shade's MetaEngine sustainability is intimately tied to the ability of builders to creatively expand the interconnected DeFi offering under one unified user experience.

The following are key principles that make the Shade MetaEngine a powerful lever for growth and sustainability:

No new token per application

Expand the breadth of apps to decrease protocol costs

Expand the breadth of apps to increase utility, fees, and security

Utilize fees to build Protocol Owned Liquidity (PoL) which enhances the utility of both apps & SHD

Combine and share capital across apps to avoid fractured liquidity

Return fees to protocol stakers

Prioritize the most efficient form of assets (i.e., staking derivatives)

Unify user experiences across all apps

Shade MetaEngine Roadmap

Due to the interconnectedness of the Shade MetaEngine, finding product market fit for one app can result in increased adoption for all other applications connected through shared functions. Over the long haul, the Shade MetaEngine will encompasses the following set of unified functions and tools that are the cornerstones of modern financial markets:

Stable currencies

Trading

Synthetics

Hedging

Leverage

Forex

Lending

Bonds

Bridging

Insurance

Asset management platforms

Treasury management

Privacy

Compliance

Arbitrage

Asset & data interoperability

DeFi primitives that partake in a larger holistic system which includes one single governance token, a unified and growing platform, and DAO controlled Protocol Owned Liquidity become a MetaEngine (ME). Therefore consisting of a sustainable and cohesive set of apps that become more powerful due to shared incentives, UI/UX, revenue, and liquidity between the participating apps.

Shade Protocol aims to be the first true MetaEngine in DeFi history.

Self Referential User Stories

The most important part of the Shade MetaEngine is that it is self-referential, which means each app enhances the rest of the applications owned by the MetaEngine. An example of value generated across a daisy chain of apps can be described with user stories below:

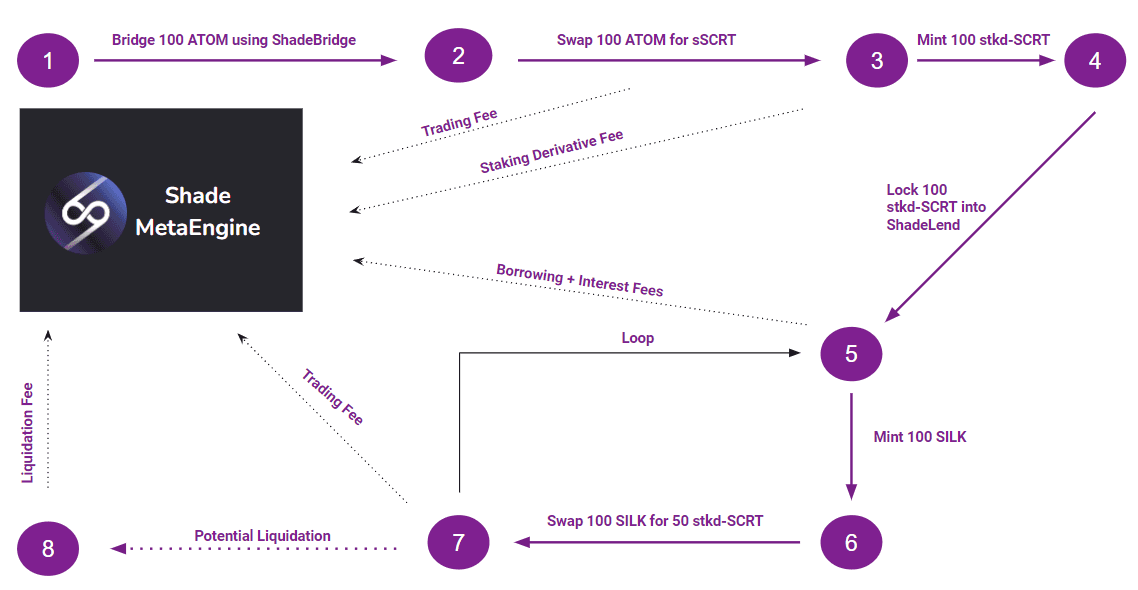

Bob would like to acquire SCRT tokens on Secret Network and then leverage stake. Bob takes the following steps:

Bob bridges ATOM into the Shade App using the Shade IBC bridge (Public Good)

Bob purchases 100 SCRT using ATOM (Trading Fee)

Bob mints 100 stkd-SCRT (Staking Derivative Fee)

Bob locks up 100 stkd-SCRT in ShadeLend (Deposit Fee)

Bob borrows 100 SILK (Interest Fee)

Bob trades 100 SILK for 50 stkd-SCRT (Trading Fee)

Bob locks 50 stkd-SCRT in ShadeLend to mint more Silk

Bob gets liquidated (Liquidation Fee)

Liquidation Arber sells liquidated assets on ShadeSwap (Trading Fee)

In a simple story of Bob interacting with Shade apps, more than 5 different types of fees accrued to the ShadeDAO. However, this is just one example based on Shade's current product suite – as the roadmap matures, the complexity and variation of these examples will evolve with the creativity of Shade users.

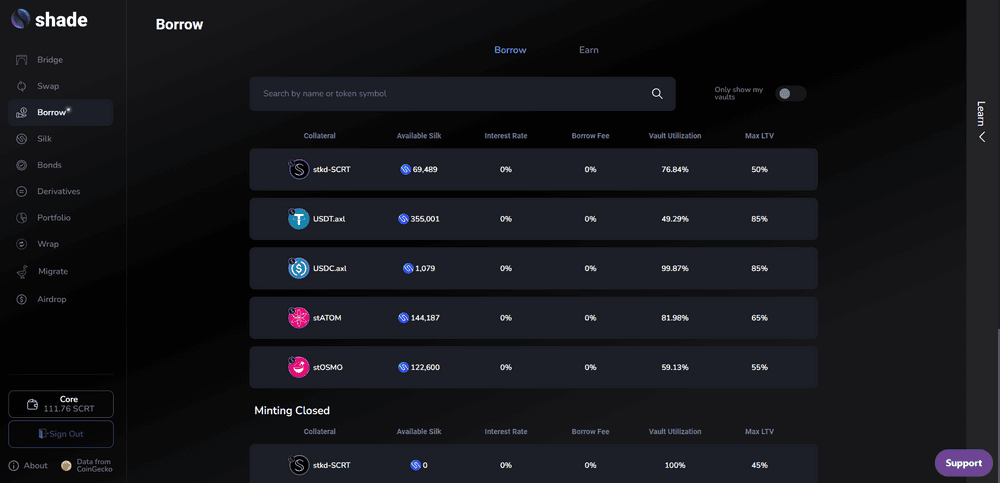

ShadeLend User Interface (UI)

More importantly, because all of the applications exist within the same interface, Bob was able to seamlessly interact with a variety of financial services to meet his needs in a way that had better liquidity and utility. The result of improving the user’s experience through a common interface allows Shade’s MetaEngine to capture more parts of a value chain previously fractured across a number of isolated applications.

In order for meaningful MetaEngine results, a MetaEngine needs to provide a service to users that generates economic value which can be shifted around in a way that generates passive utility for the protocol.

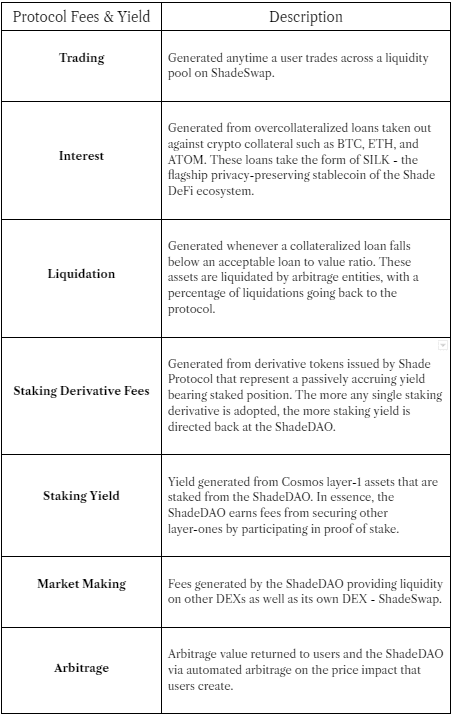

Shade Protocol provides multiple accessible services to users, resulting in fees that accrue back to the ShadeDAO. The fees accrued are as follows:

Automated Market Operations (AMOs)

Key ShadeDAO operations convert fee streams into the following:

Protocol owned liquidity

Buyback + burn

Staking rewards

Yield bearing assets

Smart contract operational gas costs

These functions use a variety of Automated Market Operations (AMOs) performed on a regularly recurring basis. The ability to modify these will come once transitioned to Governance, but currently include the following:

Purchase SHD on ShadeSwap using collected fees

Distribute SHD to stakers that was purchased on open market via the ShadeDAO

Burn SHD that was purchased on open market

Purchase SILK on ShadeSwap using collected fees

Purchase stATOM on ShadeSwap using collected fees

Mint SILK/SHD LP token

Mint SHD/ASSET LP token

Fees that get converted into SHD can be directly distributed to stakers - this distribution transfers governance power to those who have locked up collateral to engage in governance. Stakers protect the distributed admin control over certain aspects of Shade Protocol smart contracts. SHD purchased with fees can also be burned, slowly increasing the scarcity of SHD overtime. The burning of SHD equally benefits all SHD tokenholders. Additionally, fees converted into SHD can be used to provide liquidity on ShadeSwap, or other applications in the future.

Protocol Owned Liquidity

Shade believes in Protocol Owned Liquidity (POL) in liquidity pools tied to it's main token. Shade Protocol believes that making deep liquidity for SHD is more beneficial than distributing all accrued fees back to stakers. Deeper liquidity allows new users to buy into the Shade Protocol vision, and current holders are able to tap into the benefit of fees accrued in the past. For that reason Shade's automated operations currently seeks to continuously help grow:

SILK/SHD

SHD/stATOM

The SILK/SHD pool has a variety of utilities that it provides to SHD tokenholders, all of which are improved via Protocol Owned Liquidity (POL):

SILK owned by POL represents an interest payment fee stream owed to ShadeDAO

Increased SILK/SHD liquidity improves the ability of stablecoin holders to acquire SHD via ShadeSwap routing

Increased SILK/SHD liquidity makes it easier for borrowed SILK to acquire SHD

Increased SILK/SHD liquidity empowers SHD to potentially be used as collateral on ShadeLend

Increased SILK/SHD liquidity empowers SILK/SHD LP token to potentially be used as collateral on ShadeLend

Increased SILK/SHD liquidity improves slippage across ShadeSwap as a key route, for increased trading fees.

SILK/SHD LP could be leveraged to cover protocol development costs

In addition to the above benefits, every single SILK/SHD LP owned by the ShadeDAO represents buy pressure on these assets from all of the collected protocol fees being converted into SILK or SHD. The advantages of collecting ATOM liquidity via POL has the following advantages:

Increases liquidity with the most liquid localized Cosmos asset

Price correlation of SHD gets intimately tied to ATOM as liquidity deepens

Economic alignment with ATOM can convert into shared security agreement overtime

stATOM passively generates ATOM yield for the ShadeDAO

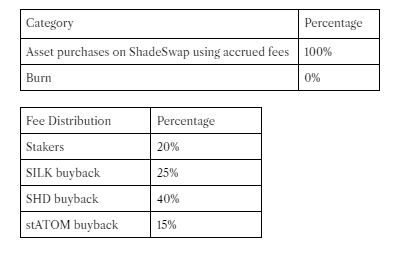

Fee Allocation Module

The following fee allocation strikes a healthy balance between key stakeholders (stakers, tokenholders, and users).

Staking fee allocation is 20% because stakers hold the longest term perspective on Shade Protocol. The ability to tap into and govern long term fees of Shade Protocol is an incredible opportunity, but this privilege must be balanced with the need to repurpose fees to deepen liquidity and increase the number of yield bearing opportunities held by the ShadeDAO (which is ultimately governed by stakers). Finally, buyback and burn is an equitable way to slowly increase the scarcity of SHD which is beneficial to all parties. This mechanic starts at 0%, but could be activated once there is a net profit when fees > emissions.

Conclusion

The Shade MetaEngine focuses on creating a sustainable closed loop ecosystem tied to user demand of underlying services. In doing so, it generates an immense amount of value in the form of fees that are continually and programmatically repurposed so as to improve liquidity of key ShadeSwap pairs, increase the scarcity of SHD, distribute governance power to stakers, improve the utility of SHD & SILK, all while building price correlation to apex assets such as ATOM.

If done in a sustainable manner, the Shade MetaEngine has the opportunity to become a platform that consists of every key financial app that will continue to improve overtime in an entirely demand driven self-sustaining fashion.

A daisy chain of public goods all working together to amplify each other with perfectly aligned incentives, creating vertical sustainability that improves accessibility, utility, and usability.

Over a long time horizon this creates a moat for the protocol, making it less reliant on outside liquidity while simultaneously turning the ShadeDAO into a core participant within the array of ecosystem revenue opportunities.

Without privacy, DeFi is incomplete. Traditional financial markets offer a degree of privacy for users, and as a result offer up greater protections in some capacity than existing DeFi markets. Shade Protocol will be the world’s first truly cohesive decentralized and privacy-preserving financial applications — ushering in a golden era for Web3. Shade Protocol will always push for privacy by default, privacy as an expectation, and privacy as the key to unlocking the full value of a decentralized future.

——————————————————————————————————————————

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.